With C.o.R.E.3 beginning next week, the Tokemak team has lined up a series of AMAs ("Ask Me Anything") with various Reactor candidates.

The Spotlight Series will allow the Tokemak community to familiarize itself with the protocols that are interested in securing a Reactor of their own, and get a peek into why these DAOs are so interested in moving away from liquidity mining in favor of sustainable liquidity.

Next up is Silo Finance, a competitor to AAVE and Compound that offers money markets with reduced risk exposure due to an isolated "silo" design.

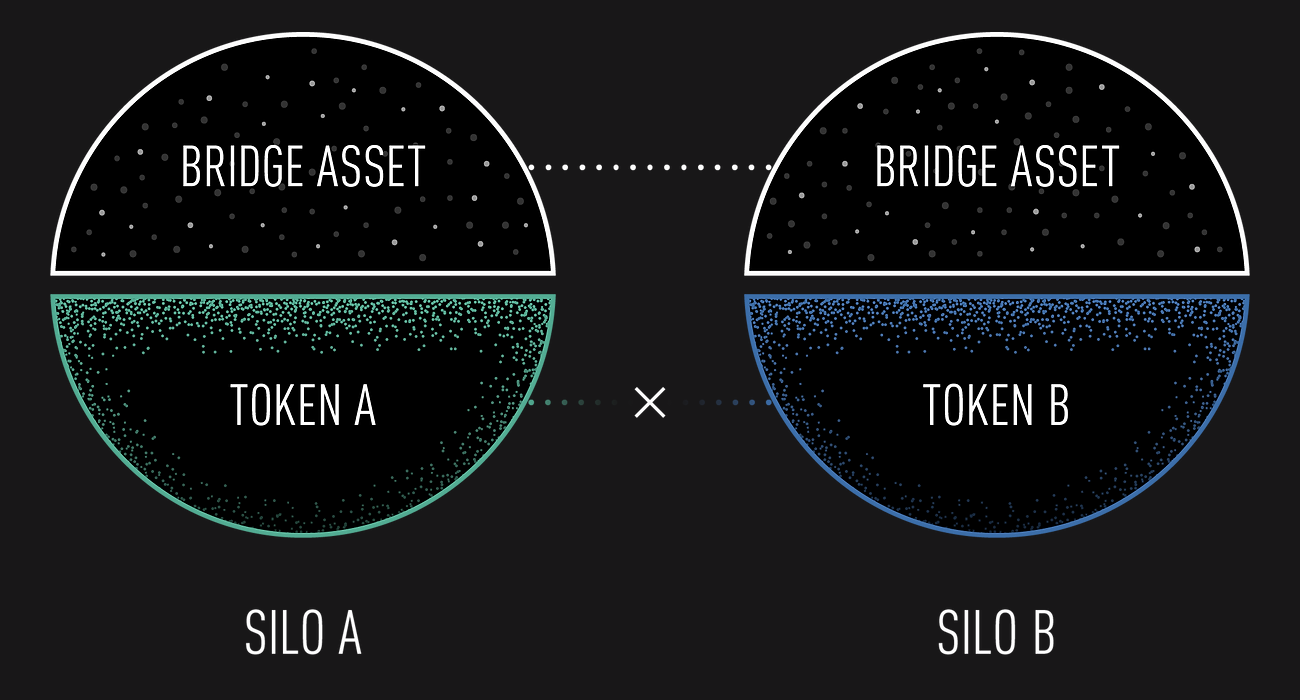

Silo is an isolated-markets lending protocol. Smart contracts have a modular design. A Silo is an isolated money market that supports only two assets, the bridge asset (e.g. ETH) and a unique token. When created, all Silos share the same collateral factors that can be configured for each Silo.

For more information about Silo Finance:

C.o.R.E. Spotlight Schedule

- StakeDAO - Monday April 25, 9:30am PDT

- Angle Protocol - Tuesday April 26, 9am PDT

- Silo - Wednesday April 27, 10am PDT

- Redacted - Thursday April 28, 10am PDT

- Rook - Friday April 29, 11am PDT

- DODO - Tuesday May 3, 9am PDT

- Immutable X - Tuesday May 3, 5pm PDT

- Paladin - Wednesday May 4, 10am PDT

- Goldfinch - Wednesday May 4, 11:30am PDT

- Badger DAO - Thursday May 5, 11am PDT

Alternatively, the recording is available on SoundCloud.

"I think Tokemak ships a lot of value to DAOs and users alike. I think the protocol drives value not only from the service itself, but also it will drive it from the tAssets and also from the mechanics that you're building for the DAOs to leverage their liquidity reserve." – Aiham

"We should strive to increase the addressable market rather than fighting for a share of the current market." – SHARP

Key Takeaways

- Aiham is a founding contributor of Silo Finance.

- Silo Finance is a money market protocol like AAVE and Compound, but uses a "siloed" architecture in order to reduce risk across markets.

- AAVE and Compound are designed to have a shared collateral pool, which introduces risk to the entire system and forces the protocols to utilize whitelists in order to ensure rugpulls and other risky assets do not affect the entire system.

- ETH is currently used as the sole trusted bridge & collateral asset. This acts as self-governing security since each new Silo pool requires a counterparty to provide valuable ETH collateral.

- If a single Silo is exploited, the remaining Silos across the system are unaffected.

- Silo can potentially be integrated with Tokemak as a destination venue so that Liquidity Directors can point assets towards Silos, allowing for increased yield and the added benefit of no impermanent loss.

- tAssets could also be directed towards Silo to allow the Tokemak protocol to take out leverage against its tAsset position.

- ETH held by Tokemak could also be deployed to Silo using sophisticated strategies to seek high yield based on defined risk parameters.

- Silo v1 is currently under audit, which is expected to be completed mid-May. v2, which will include permissionless Silos, is already under development.

- The Silo Finance team is taking a methodical approach to development in order to be as secure as possible.

- Aiham emphasizes the importance and frustration of audits. Auditors are in high demand – TrailOfBits has already been booked to audit v2 in 2023.

- Silo would like to introduce a native stablecoin that could be used as credit collateral and trusted bridge asset.

- The addition of a stablecoin as a bridge asset would allow users to deposit ETH collateral, borrow stables, and redeposit back into Silos to leverage their ETH position.

- Silo launched directly to the community, selling 100 million tokens in December, and does not have any VCs.

- The project has struggled with incentivizing deep liquidity. Current strategies include purchasing CVX and voting on gauge weights to provide emissions to the Curve pool.

- A Reactor would be another resource to supplement liquidity on Curve and Uniswap v2.

- CJ from Tokemak: "We intend on creating a system that encourages DAOs to deposit reserve assets."

- The end goal of Silo is to be immutable and permissionless with thousands of individual markets, with other protocols building on top of Silo.

"Silo was born from this frustration that you have many token assets in your wallet and you cannot use any of them to borrow leverage or even short. And it felt like this limitation from current money markets. Why restrict certain token assets from being used as collateral – is just sometimes even arbitrary." – Aiham

[00:00:00.250] - CJ

All right. Hey, guys.

[00:00:01.570] - SHARP

Hey, everyone.

[00:00:03.110] - Aiham

Hey, SHARP. Hey, AJ. Hi, SHARP. Hi, CJ. How are you guys doing?

[00:00:09.540] - SHARP

Well, glad to have you here. I was just talking with CJ and the rest of the team about Silo on our standup meeting and really excited for you to let our community know everything about Silo.

[00:00:24.470] - Aiham

Absolutely. I appreciate it.

[00:00:26.610] - CJ

So let's just give everyone a minute to filter in and then we can kick things off from there.

[00:00:31.970] - Aiham

I was thinking, CJ, how do I drop some files or where do I drop files? Do you have like a channel here? Yeah.

[00:00:41.830] - CJ

I'm wondering if I can give you CoRE channel on the left...is going to be a good place to drop stuff. But let me see, I'm not sure if there's a video component stage.

[00:00:54.410] - SHARP

And regardless I'll also share them on Twitter because as soon as I saw them, I think that everyone will understand the synergies that can happen between both protocols.

[00:01:03.530] - Aiham

Yeah, that would be great. So you'll be sharing the files, I understand in the CoRE3 channel, but I have them as well. So whatever you choose is okay with me.

[00:01:16.430] - CJ

I think he'll drop them on Twitter. So if you can put them in the CoRE3 channel. Yeah, if you drop them in the CoRE3 channel right now, that'd be perfect.

[00:01:23.320] - Aiham

All right. Absolutely.

[00:01:28.290] - CJ

Looking forward to learning more about Silo and seeing how collaboration with Tokemak can look like here in the future. AJ, welcome.

[00:01:38.190] - Aiham

Thank you so much. I really appreciate it. I am a big fan of Tokemak. I've talked to the team before. I've been following your progress, guys. I'm super excited about the future.

I think going in the direction of permissionless is the way to go. I think it's the same similar vision we have on Silo. So I'm super excited to be here to introduce Silo to the community, of course, and answer any questions, show a little bit of what we can do together, regardless of whether we are going to have a Reactor or not, of course. But regardless, I think I'll see a lot of synergies between both projects.

So about myself, I'm one of the founding contributors of Silo. So to tell you a little bit about Silo, I kind of worked a little bit on a slide or like why Silo image that you can see in a CoRE3 channel. I wanted to illustrate to you what is Silo and how it works. Exactly. So to kind of simplify things today in lending, if you use a protocol like AAVE, well, the way the AAVE or Compound design is that all tokens usually sit in one big pool where a limited number of tokens are allowed to be used as collateral to borrow something else.

[00:03:13.220] - Aiham

So you would, for example, deposit USDC and then you borrow, let's say, WBTC. The problem is that because all these tokens sit in one big pool, if one of the tokens gets exploited, as we have seen before, then the exploiter can run away with all the tokens in the pool. So yes, tokens in the pool share efficiency, but also share risk.

So we came up with this idea of isolated money markets. So as you can see in the image, instead of having all tokens in one pool, we actually isolate tokens. Each token gets one market, or we call them "Silos". So basically you would have Silo for FRAX, you would have Silo for TOKE, you have Silo for ALCX, or even for the LP tokens, the tTokens that you have guys. But now we have these fragmented Silo in the protocol.

So how do you bridge them together? How do you enable FRAX to borrow ALCX or how do you enable tALCX to borrow FRAX, for example? Well, the idea was to use something we call the bridge asset, or basically ETH, as you can see, exists in every single isolated market. So in effect, if you have some tALCX and you want to leverage that to borrow FRAX, you would deposit in its Silo, you would borrow ETH, and then you would take that ETH to the FRAX Silo, you deposit that ETH there, and then you borrow FRAX.

[00:05:07.510] - Aiham

So technically you do four steps, but of course you can bundle them into one transaction. So now, in effect, you've isolated risk, because if the value of tALCX, let's say, for some reason gets exploited...well, users in the FRAX-ETH Silo are isolated because ETH is the collateral, it's not the ALCX. As you can see here, this risk isolation basically happens by design, because each token has its own isolated market and ETH is the only trusted collateral on the entire protocol. So if you want to hack or exploit the protocol, you'll have to exploit ETH. And we think that's almost impossible because simply ETH is super liquid on the market and extremely decentralized. So it's very difficult to exploit. And that's pretty much like in a nutshell, what Silo is and how it works.

[00:06:13.790] - SHARP

Yeah. As I said previously, I've been following Silo since you guys won the hackathon. And something that I would also like to highlight to the community is that this is very much different from, for example, Rari, because on a Rari pool, you maintain exposure to all the assets that remain within that pool. So the risk is still there, present to the assets that you are exposed to. With Silo, this is entirely different. And all of these risks are isolated and mitigated. Using if as a bridge between all different Silos.

[00:06:49.640] - Aiham

Exactly. And also in isolated pools like Rari, of course, they have their own use cases. You fracture liquidity, because if USDC exists in two pools, they're basically fractured. In Silo, you only have a single Silo for USDC. Yeah.

So the beauty of this design...we allow any token to have a market that could be a blue chip token. It could be a derivative. It could be even an LP token, like the tTokens. It could be even ERC721 tokens. So if that represents a liquidity position, for example, you can definitely even have that. So you can have a long tail.

So basically that's our goal is to have permissionless markets. Anyone can create a market. However, the ability to have that money market is basically activated. You have to find a user, an ETH user that is willing to counter a part of the risk. So, for example, if you don't find ETH, well, the tALCX user will not be able to borrow anything in the protocol because there is no ETH that exists in the Silo. So it's up to the market to decide if a certain token is risky or not, or even the level of risk.

[00:08:17.670] - Aiham

So if you trust FRAX, you would probably supply a lot of ETH. If you think a token is a rug token, you simply do not provide any ETH. And even if they have Silo, they're not necessarily able to borrow the ETH and borrow something else in the protocol. So in other words, there is no governance to say you're only allowed to borrow, let's say, $10 million against your tALCX. It's completely capped by you finding a counterparty risk taker or risk maker. Actually kind of a maker that is willing to give you ETH so you can borrow it and borrow something else against it in the protocol.

[00:09:02.780] - SHARP

I love the approach of just letting the market decide...and just to also understand this component. So governance here is basically nonexistent. Right? You don't need to whitelist new assets. You can just deploy a new Silo and let the market specialize with that Silo, right?

[00:09:22.420] - Aiham

Yes, that's pretty much the long term vision. So let me actually kind of take a step back here. You can create a market or a Silo for any token asset as long as there is liquidity for that token, because we need to read the price of that token. So they have to have some liquidity. Exactly.

Now, long term vision, probably v2 next year, it will be completely permissionless in the sense that you create it. Even if that's a rug token with $100,000 liquidity and then you create it that's fine. But we will use our utility to tell you like, hey, this is probably super risky for you, so at least, you know. But yes, the long term is exactly the way that you create liquidity pools on Uniswap v2, or probably you guys, where you're headed in the direction of having permissionless Reactors, and maybe in the long future where anyone can create a Reactor and you do not necessarily let the user decide to ascribe a certain risk level to that certain token. So that's kind of like how I think a little bit about Silo. Now, I created kind of like a growth flywheel between both protocols to explain a little bit of what it means to basically Tokemak to work with Silo or of course vice versa.

[00:10:54.580] - Aiham

So the idea here is...because now we have many markets, and these many markets, they need liquidity. So the way you send liquidity today to Sushi, for example, you can send them to Silo. But of course the difference is you don't incur any impermanent loss because simply that liquidity sits. And if there is someone willing to borrow that liquidity, you're basically making interest and that interest translates to basically a certain APY that you generate and then you can distribute it. So we think that the higher the APY that we can generate for you, that would probably reflect in more liquidity flowing to the token Reactor...and maybe provide incentive for projects to actually have or apply for Reactors, or maybe create them themselves when there is a fully permissionless solution that's for the majority for the tokens. Basically whatever Reactor that you have. But also we can create a leverage market for you guys. So you have LP tokens, you provided liquidity and now you have these tTokens that you can use as leverage but you don't want to risk them by sharing that tToken with other tokens in traditional lending protocols. So what do you do?

[00:12:35.940] - Aiham

You actually put them in isolated markets and now your ALCX can borrow anything in the protocol. And we think because now you've given this tToken an additional utility that would encourage probably users to basically provide liquidity to Reactors...because now you're leveraging that not only making revenue or you're making a yield on your deposit in a certain Reactor, but also taking that tToken and leveraging your position. Leveraging your position. So I think that will also have a great effect on the numbers of Reactors and the depth of each Reactor. Yeah.

[00:13:25.130] - SHARP

And it adds a lot more capital efficiency to all of our Tokemak users. Besides also incentivizing more Reactors to essentially apply to Tokemak when we reach the permissionless phase, which is something that we are very excited about...it's also something that is kind of parallel to the development. I see its parallel, exactly.

[00:13:46.580] - Aiham

And there is also even something else that you guys can do in the future because we're building a primitive and let's take for example ETH as the market maker, but if should always look for the highest APY. So if the borrowing rate of ETH is going to be different from market to another depending on how the market is. For example, if you have CVX, if and there is a great demand basically to borrow CVX, you will see higher borrowing APY on ETH in that Silo. So probably liquidity will flow to that Silo because there is a higher APY deposit APY that you make.

So what I mean here is that your liquidity that flows from Tokemak to Silo can go through simple strategies where you can say hey, I trust ten markets. Let's say there's stablecoin, whatever. And I'm willing to rebalance that if always for the highest APY. So it's not necessarily just you provide liquidity, you provide ETH to one Silo and you sit and you just enjoy a little APY. But it also can create a little bit of sophisticated strategy, safe ones, that kind of move that ETH always looking for the highest APY within a certain risk parameter.

[00:15:22.510] - Aiham

So you can always say, for example, that it can only rebalance between USDC, USDT, DAI and FRAX, for example. And that will set the boundary for that strategy.

[00:15:33.710] - SHARP

That's really exciting. So essentially, it's like a whitelist from our side where we allocate capital that will be rotated through the ETH APY and all the assets that are trusted by Tokemak.

[00:15:50.100] - Aiham

Exactly. And you can even create that strategy and simply not allow anyone to add or remove any Silo, just to make it completely secure. No one can basically maliciously add a Silo after that strategy is deployed. So basically, you make it immutable. Yeah.

[00:16:10.480] - SHARP

And it will be self-contained to the whitelist that we agree upon.

[00:16:18.350] - Aiham

Exactly. And that's up to you. Exactly. And the last slide I probably talked about this, basically integration is...I see it in both ways is basically kind of the liquidity flowing to the money markets and creating a utility for your LP tokens where you can safely leverage up your holdings basically, and without risking losing your liquidity altogether because you're sharing risk with other tokens. That's kind of like in a nutshell.

And these markets can be infinite. You can create markets for...I've checked how many liquidity pools that you've created on Curve, for example. And I think there is a direction you're going into kind of creating this liquidity between the underlying token and the wrapped one, which is I think it's a great strategy long term. And we can definitely utilize Curve to make sure that our lending protocol can always create markets for these tTokens and also utilize them to liquidity to protect liquidity providers. Yeah.

[00:17:40.320] - SHARP

And ultimately it allows many markets to also liquidate their positions and also to connect users to exit their positions mid-cycle.

[00:17:48.890] - Aiham

Exactly.

[00:17:50.750] - CJ

So, AJ, it's great to hear that there's additional use cases for tAssets. I think our community is going to love hearing that. Really quick: if anyone in the audience has questions for AJ, feel free to drop them in the CoRE3 channel and we'll get to them at the end. We'd love people to submit them there. AJ, you mentioned v2 you were releasing next year. Did you have a tentative date for v1 releasing?

[00:18:14.820] - Aiham

Not really. We're trying not to communicate timelines because we are still under audit. But as of today, we think the audit is going to be done by mid-May. All of it, both audits. So we have one ongoing audit with QuantStamp, another one with ABDK. But again, of course, from that point onward. There's a lot of work that needs to happen. UI integration with smart contracts and a lot of testing. So really, we don't know because we're dependent on auditors.

[00:18:57.990] - CJ

Got it.

[00:19:00.210] - SHARP

Audits usually are frustrating, and sometimes it's hard for the community to see that a lot of the development is always injured by the waiting times for audits. It can be frustrating for all parties, but it's necessary for the safety of our users.

[00:19:17.190] - Aiham

Absolutely. We are a security-first protocol. We're designing the whole protocol to be secure. So it just doesn't make sense that we undermine our security strategy just to gain a few weeks. Exactly.

But I really don't blame the community. They're excited, they want to see a product. And until you release, you really don't necessarily trust 100%, which I understand. But there's also a perspective that, well, an auditor tells you we're going to start April 1, and they start May 1. You really can't do anything about it. That's it. You wait. It's frustrating. But this is how we operate in this uncertain environment and we have to accept it. Yeah.

[00:20:07.990] - SHARP

Sometimes even getting out, it's already a nightmare by itself.

[00:20:12.950] - Aiham

Exactly. Actually, yesterday, this is something I haven't told the community that yesterday we booked Trail of Bits for 2023. So it's like a year from now. Exactly. And you have to organize your releases around the audit availability. Usually it should be the other way around.

[00:20:38.400] - SHARP

But anyway, the unseen part is definite. I'm pretty much a definite. The protocols that capture my attention always have full deep dive. And I recall because I'm also part of the Silo community that there were talks regarding Silo stablecoin. Do you want to elaborate a little bit on that?

[00:21:03.600] - Aiham

Yeah. So basically the idea here is that if you add a second bridge asset so it's not on the ETH, you, let's say bring a stablecoin. There's a lot you can do with a stablecoin. So first of all, the easiest thing is that a lot of users would love to borrow a stablecoin instead of ETH and then take that stablecoin and deposit it in a different Silo, because a stablecoin doesn't fluctuate and probably you'll have less headache managing your borrow position. And that's like from a UX perspective.

But also we think we can do a lot with the stablecoin. So if it's a stablecoin, we can even extend the credit from the protocol a little bit because we know that our interest model will always try to keep utilization at 80%. So you always have like 20% unused. So you can always maybe extend maybe 5% of the 100% to users to certain Silo. And of course, that could also give like a use case. But also we're thinking long term, the stablecoin, which is the v0, is going to be just wrapping USDC. But long term, we want to create a system where multiple stablecoins can back the Silo stablecoin.

[00:22:45.410] - Aiham

So we do not have to maintain the peg. And then because you're backing a stablecoin and now you are a major, you are the bridge asset in a lending protocol. That's worth something. So you have to pay for that privilege, because simply having a stablecoin in a lending protocol creates a lot of demand for that stablecoin. And it's kind of an easy way to scale that debt from a stablecoin perspective. So that's also a way for the protocol to leverage, to ship more value to users.

[00:23:23.670] - SHARP

I'm just wondering: imagine I'm part of the sale community and I want to run a stablecoin strategy where I'm using the stablecoin to essentially cycle through the highest rates among the list of whitelisted assets that I trust. Would this strategy be possible?

[00:23:45.030] - Aiham

Absolutely. Any bridge asset can be used in that way for sure.

[00:23:48.920] - SHARP

So essentially, for example, I could, for example, select, let's say, ten Silos that I trust and just say: okay, I'll use the stablecoin, and the stablecoin can be rotated through the highest APRs that I have on all of these followers.

[00:24:06.760] - Aiham

Absolutely. Exactly the way it works. And there's an additional thing that for ETH users can use. So, because ETH exists in every market. So if you deposit your ETH and you want...and now you're giving basically your ETH to anyone who is willing to borrow it and use it as a collateral somewhere else. But maybe you want to do more with your ETH. So right now, without a third bridge asset, second bridge asset for you, for example, you are in the let's say you're actually in UNI ETH Silo and you provide ETH. And the only way for you to use that ETH as a leverage, you have to borrow UNI, sell it for stablecoin, and take that stablecoin and deposit it somewhere else in the protocol...and maybe borrow something else, which is basically you shorting UNI, which is a problem. But if there is a stablecoin as a rich asset in each Silo where you have your ETH deposited...so you're making a deposit APY, you can borrow the stablecoin and take that against your ETH, and take that stablecoin and maybe deposit it in five different Silos depending on the APY.

[00:25:31.970] - Aiham

So you can leverage your ETH. So technically, now you're giving your ETH to other users in the protocol, but you're also borrowing against a stablecoin, and now you're making markets and you're making multiple deposit APY on it. So that's a great exit strategy for each depositors in specific, maybe. I'm going a little bit technical here, but there's having a second one.

[00:25:59.350] - SHARP

This is really, really exciting, and I'm really looking forward to see all of these developments with Silo.

[00:26:06.730] - Aiham

Yeah. Thank you.

[00:26:07.920] - CJ

On the next subject, it looks like your Silo token has been around since December, if CoinGecko is accurate. I'm wondering if you can touch on your thoughts on liquidity. I see you currently have a UNIv3 pool up, but curious what your thoughts have been on liquidity and any challenges or struggles your team has had in terms of how you've approached liquidity for the Silo token.

[00:26:36.260] - Aiham

Yeah. So the token supply that people see right now on CoinGecko is around 100 million. This 100 million we actually sold in a token auction. Silo did not sell to VCs. We went directly to community and it was permissionless back in December 1 or around the first we minted the tokens and we sold 10%.

The struggle has been, well, how do you build liquidity? I think the team is against using Silo to incentivize liquidity because eventually they'll simply sell the token, and there's no benefit from it. So it's been a little bit of a struggle for us to create a deep liquidity. Uniswap v3 is created by the community. It's not incentivized at all. Until recently, we decided to buy basically CVX Convex. And then with the help from the community, we had our gauge and we got voted, and again because of the community support. And we now vote with our CVX for emissions, which is extremely a process. We had to buy CVX and now we're basically exposed to the risk of CVX. And that's been a struggle basically. And it's a good solution, but it also has its own disadvantages, I would say. So that's kind of like the route.

[00:28:16.410] - Aiham

So having, let's say today having the ability to have a Reactor, I think the community would be open to kind of allocating a little bit of tokens basically as a reserve to protect against IL. And then the community would probably be more willing to provide liquidity in that case. And that would probably supplement whatever liquidity that we have afloat. We would have loved it if you guys had directed you could direct liquidity to Curve. But even Uniswap v2 is not a bad idea. It's actually a good idea. So that's kind of like in the journey.

[00:29:01.770] - SHARP

Curve v2 will also be liquidity destination. So definitely the options.

[00:29:10.090] - Aiham

Fantastic. Yeah. So that's been a journey. And I think the community at one point...if you go to our governance forum you'd see like, we have examined, they have examined every possible way from having a Reactor to buying CVX to even using kind of like those liquidity as a service platform and really different options. And there's so many of them. But I personally like the Tokemak approach, of course, to solving that problem. And I see the benefit of it. And I also see that even providing this IL protection, although you use the claim to it. But even maybe in the future, maybe there will be like some ways and I'm kind of...ways to at least benefit from that reserve, benefiting the DAO basically from that reserve.

[00:30:04.030] - CJ

Yeah. SHARP has been working on some mechanics there, so I'm not sure if he's going to leak them yet, but we intend on building a system that encourages DAOs to deposit reserve assets for sure.

[00:30:13.700] - Aiham

Yeah, exactly. And I see it honestly, I kind of see how this could evolve into something more meaningful. I think Tokemak ships a lot of value to DAOs and users alike. I think the protocol drives value not only from the service itself, but also it will drive it from the tAssets and also from the mechanics that you're building for the DAOs to leverage their liquidity reserve.

[00:30:44.830] - SHARP

Liquidity, yeah, definitely. That's something that we are actively working on, and it should be released and outlined pretty soon. But the entire goal is to move towards a permissionless setting Pair Reactor and also benefit the DAOs that set up a reserve for each one of the Reactors. And also very exciting: our liquidity multiplier has recently been increased, so we are also scaling our liquidity deployments. And as I said, security is always a priority. It's preferable to move forward, but make sure that everything is working as expected.

[00:31:27.490] - Aiham

Absolutely. And I think you have a really strong community that I kind of appreciate the effort it takes to bring a solution to. Actually, it becomes more difficult once you've built. Something becomes even more difficult to ship because now you have established high standard in the community. So everyone expects you not only in terms of solution, but also in terms of security. So it's cool.

[00:31:56.890] - SHARP

Yes, definitely. Tokemak is extremely community driven. For example, I was hired from the community and a lot of community members are crucial contributors to Tokemak. So we always really appreciate the support that we've had throughout this entire journey, and we're very excited to build out for them.

[00:32:19.870] - CJ

So, AJ, moving on...what is the most successful version of Silo? Where do you want to be in two years, three years? What's the best case? Bull scenario?

[00:32:32.470] - Aiham

Number one, we're permissionless. Once you've deployed a Silo, it cannot change. It's immutable, so you can build on top of it the way you expect Uniswap pools to perform today. We have over 2000 markets in the thousands. I would like to see that in the thousands. And there are a lot of protocols building on top of Silo and making it easy for the user just to provide ETH within a whitelist of Silos and that generates the highest deal possible for them.

And also the last part would be some also solutions that built on top of Silo where your isolated positions become easier to manage, because that's one of the disadvantages of isolating positions is that...now you've deposited a token, you borrowed ETH, you deposited ETH, and then you borrow something else. So you have now many positions, and you have always be kind of aware of what's happening to these positions. So maybe a way of cross marginal solution would make it easier for the users to manage their positions. But I would say the number one: we're permissionless, any user can create a market for any token, number one.

[00:34:04.930] - Aiham

Number two, we have...we really enable you to use any collateral, any token as collateral to borrow something else. And that is the highest goal or the goal that we want to reach.

[00:34:19.730] - SHARP

Hopefully with v2, there could even be an interesting feature where there would be, for example a Silo Reactor where the risk of each one of the markets could be mitigated by TOKE stakers that are staking to that Reactor, which would be entirely different from current Reactors that we use just for LPs. Tokemak DAO governance could decide the whitelist of markets that we are participating in. Users could just deposit ETH and essentially get that ETH yield within Tokemak. So that's just something that I thought about right now.

[00:35:02.360] - Aiham

Exactly. And can even borrow. By the way, the deposit is ETH and you can definitely even create safe strategies to borrow against that if that would even leverage more. Yeah, absolutely.

[00:35:14.680] - SHARP

Yeah. Really exciting. But I really think that what we saw with Rari was a major advance when compared to the money markets that we had previously with, such as AAVE and Compound. But Silo adds even more functionality in terms of not having the risk exposure to all the assets that are present within that tool. And it's an evolutionary step for many markets that is really amazing to witness.

[00:35:46.610] - Aiham

This. Silo was born from this frustration that you have many token assets in your wallet and you cannot use any of them to borrow leverage or even short. And it felt like this limitation from current money markets. Why restricting certain token assets from being used as collateral is just sometimes even arbitrary. You see that a certain token which is risky and not allowed, but you can use it in AAVE or Compound to borrow against. But then others for example, today FRAX, you cannot even use FRAX as collateral to borrow in AAVE, for instance. And I know the design of FRAX really well and I know how secure they are just simply. However, you can use xSUSHI to borrow against as collateral. It seems like arbitrary, but I understand it.

Of course, I'm sure there is a reason and I'm sure that the risk committee has done a lot of...have done their homework on the average side. But I would love to see FRAX being used as collateral and eventually to remove that kind of doubt. You just create permissionless markets and isolate them. And of course that will come at a little bit of disadvantage in terms of efficiency, in terms of managing positions.

[00:37:12.710] - Aiham

But there isn't really a silver bullet here.

[00:37:15.820] - SHARP

Yeah. I personally entered Rari when I saw how difficult it was to be whitelisted on the existing money markets. And the issue is also that going through the governance process sometimes also implies overcoming interests that exist within the current large whales that control governance. So there's a whole process that we need to go through and have permission with many markets...is definitely the way forward. And again, this is something that also needs to be emphasized, which is: there is more than the market share for all of these protocols to coexist. And I believe that they serve different value propositions.

[00:37:59.790] - Aiham

Yeah, absolutely. And DeFi is still kind of a nascent ecosystem. So I think in five years, it's not crazy to say that DeFi is going to be 100x what it is today...so definitely you need more markets. And eventually...I personally love it as a user to have more choices. So even I'm, of course...silent contributor, but I always advise users to use different lending protocols at the same time. Spread the risk. That is the best way. So yes, it's not a winner takes it all market for sure.

[00:38:38.460] - SHARP

Yeah, definitely. I think in a kind of mentality where we should strive to increase the addressable market rather than fighting for a share of the current market.

[00:38:49.930] - Aiham

Yeah, I agree. And here at Silo we're open to working with really anyone and we do not perceive...yes, of course we know how to compete. We're very competitive. But we also like to see we know that if you work with other protocols, even if there's lending protocols...just get better because of the composability of DeFi. So that's how we perceive things.

[00:39:19.350] - SHARP

I'm very familiar with the entire FRAX design, but something that also differentiates FRAX, for example...it's their attitude towards other protocols, and they really have the positive ingrained within their culture. That's something that we can all benefit from. But looking at style of, for example, something that I see, it's also the rise of the DAO to DAO necessities and for example, new projects that spin up their tokens. They will also really benefit from permissionless listings and protocols like Silo.

[00:39:52.190] - Aiham

Absolutely. And even before we're permissionless, we're going to list...there's no issue. We will not stand in the way of any protocol to list their tokens. The idea is that we can't make it permissionless right now because all the way because we have to choose the price oracle, because otherwise you would choose basically a rug pool on Uniswap v3. You would run it and then you can drain the pool. So that's the only way. That's why right now we just control this.

[00:40:31.550] - SHARP

Something that's very exciting for me about Curve v2 is also the fact that you have a price oracle within their pools. Right. So using LP tokens from Curve v2 is also a possibility for Silo money markets.

[00:40:47.230] - Aiham

To read the price. Exactly. Although there are little bits of complexity around that. But definitely it's very exciting. If you can liquidate the LP token easily, that's going to be leverage...gives leverage to everyone. And this is something we are going to work on immediately after beta.

[00:41:08.040] - SHARP

Yeah. I was a little bit confused at first when I saw that the cvxFXS pool on Curve was a Curve v2 pool. And then as soon as I realized, well, the price oracle, obviously...it makes total sense that they will also use this as an advantage. Besides other advantages such as returning the pool easier to pay. But it's definitely something that I'm very excited about. So I look in leverage.

[00:41:35.830] - Aiham

Yeah, certainly all lending protocols should leverage that actually, because the more markets we have...because liquidity will always be...for example, in Silo, it's about the ETH that is willing to counterparty risk. So that's why sometimes there is liquidity, sometimes you've borrowed all the ETH. So, hopefully the other protocols will also do that so liquidity will kind of increase across all protocols. And that's a good thing. Because actually, to tell you the truth, if you actually look at some of the large liquidity deposited into AAVE and Compound, actually large liquidity comes from Compound and vice versa. And again, just probably to farm the token. But these things happen. So that's why these are money markets connected across DeFi. So yeah, that's not your flow.

[00:42:41.070]

Awesome.

[00:42:41.570] - CJ

AJ, this is a great conversation. Looks like there haven't been any questions in CoRE3, which means you've been doing a good job giving them enough details to fry their brains as is. Really appreciate you joining us today. Where can people go to learn more about Silo or keep tabs on your progress?

[00:43:02.670] - Aiham

Yeah, so follow us on Twitter, guys, I'm just going to post the link if you don't mind. This Twitter...always great. And if you have any questions, we have...excuse me. Yeah, I'm sorry, for some reason I got disconnected. Apologies. Hello.

[00:43:28.190] - CJ

We got you.

[00:43:29.500] - Aiham

Okay, great. So follow us on Twitter and if you have any questions, we have a very active community. I would love to answer your questions and just maybe if you want to join, this call would be great...and that's probably the best way to learn about us or ask questions.

[00:43:50.790]

Great.

[00:43:51.140] - CJ

Well, AJ, I really appreciate the time. Everyone go check out Silo Finance and, yeah, looking forward to your participation.

[00:43:57.810] - Aiham

Absolutely. Thank you so much, guys. It really was a great opportunity to talk to you and the team in the community and we look forward to working with you and the community in the future.

[00:44:10.380] - CJ

Sounds like a plan.

[00:44:11.280] - Aiham

Thank you.

[00:44:11.770] - CJ

Alright, thanks.

[00:44:13.090] - Aiham

Thank you so much. Bye. Bye.

[00:44:14.510] - CJ

Bye.