On October 15, Arca published an interview with Carson Cook (@LiquidityWizard) in which he spoke about the new over-the-counter (OTC) crypto trading and clearing platform he's launching called Lattice and Membrane.

Arca Endeavor recently launched a $30 million fund and has invested in Lattice. Transaction terms and valuation have not been announced.

Besides the platform itself, one of the more interesting aspects of the interview was how the project was born out of Carson's own encounters with the complete lack of institutional-grade crypto market infrastructure, both through his work as a management consultant and as a professional market maker.

Based on public information, Lattice has nothing to do with Tokemak... for now.

But we'll get into that later.

What is Lattice?

Lattice is a cross-chain digital asset trading, lending, and price-aggregation platform that lives on top of an algorithmic clearing and settlement engine, purpose-built for OTC crypto market flows.

Who is Lattice built for?

For starters, OTC crypto markets consist mainly of institutional participants like hedge funds, venture capital firms, family offices, high net-worth individuals, miners, broker-dealers, asset management funds, and private banks.

Lattice provides solutions for two kinds of participants in the OTC crypto market: those who rely on qualified custodians (i.e. BitGo, Coinbase Custody, etc.) to custody their assets, and those who access on-chain opportunities via self-custody solutions (i.e Ledger, MetaMask, etc.)

Third-party custodied participants will have access to the main Lattice platform, whereas self-custodied OTC desks and investors will have access to a similar platform called Membrane.

In addition to the trading, lending, and clearing functionalities, Membrane users will have the opportunity to earn $BRANE tokens in proportion to their platform activity, and this entitles them to a share of total platform fees. In other words, $BRANE is like a fee-rebate token.

Which problems do Lattice and Membrane solve?

To answer this question, we need to understand why OTC markets exist and identify some of the core pain-points and excess risks that market participants currently face.

Whether in traditional or digital asset markets, OTC exists to allow institutional investors and participants to execute large block trades.

It is important to note, however, that OTC services fall under the broader umbrella of so-called 'prime services' which includes activities like cash and securities borrowing and lending, structuring, clearing, research, and market access.

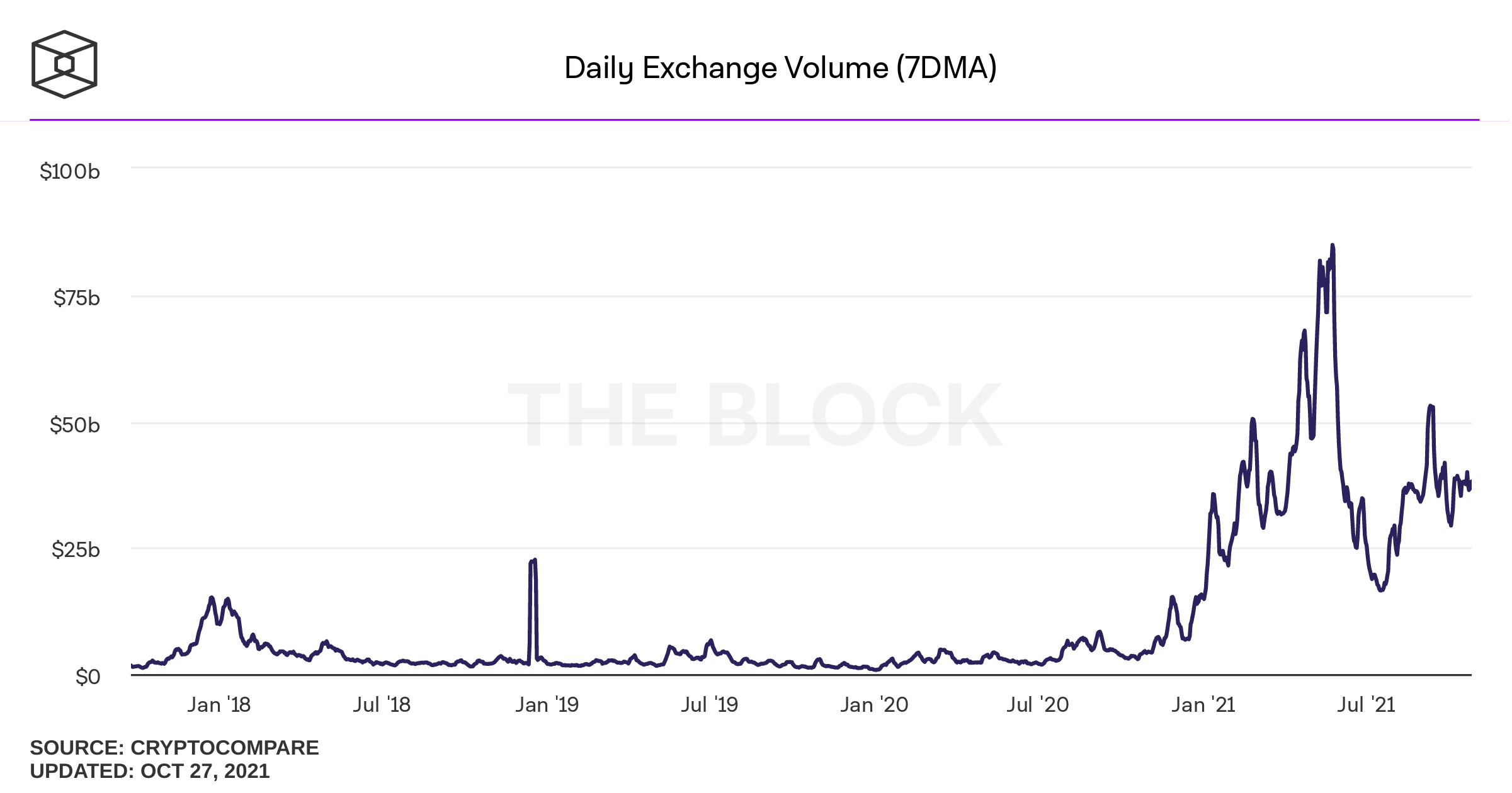

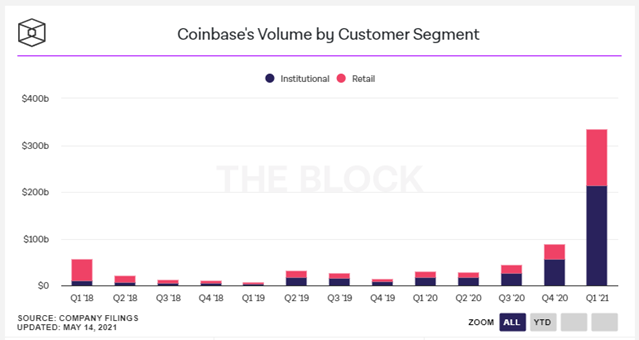

Depending on who you ask, daily OTC crypto trading volumes are anywhere from 2-3x that of spot markets. Excluding decentralized exchanges (DEXs), this puts daily OTC volumes at well over $110 billion based on the most recent exchange volume data:

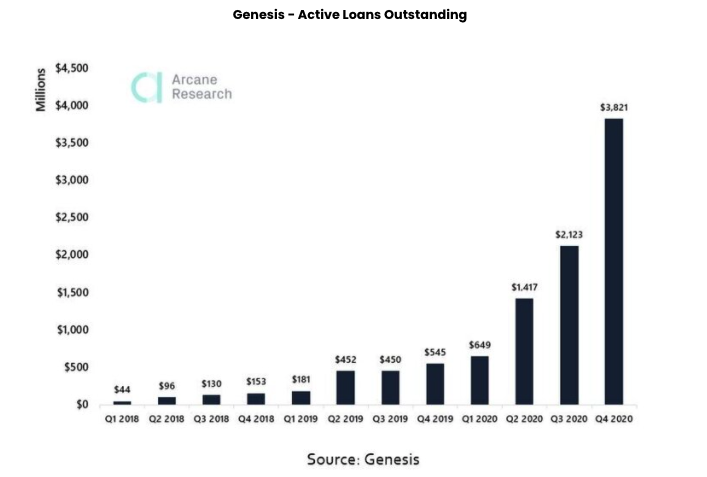

Institutional OTC crypto lending has also taken off, as evidenced by the data provided by Genesis, the leading institutional-focused lender, reaching close to $4 billion at the end of last year:

Circling back to trading in traditional financial markets, there are two primary ways that transactions occur: either through centralized exchanges (CEX) or OTC.

Crypto is no different except we also have DEXs that aggregate liquidity across bonding curves.

On a CEX, limit bids and asks are aggregated into a central limit order book (CLOB) and all exchange participants can view market depth.

Here, the exchange intermediates by matching buyers and sellers, and taking a fee on both sides of the transaction.

OTC differs in that trades occur directly between buyers and sellers, where one counterparty is usually an OTC "desk" which specializes in buying and selling crypto assets in bulk through a broker-dealer and client network.

When both parties agree on the terms of the transaction, they will sign a contract and arrange for the transfer of assets, also known in the industry as delivery-versus-payment (DvP).

Based on this comparison, some of OTC's key benefits to institutional participants become clear:

- Liquidity - Trading large quantities OTC, instead of on exchanges, means that the participant can practically eliminate slippage.

- Privacy - Since transactions happen off-exchange, participants are able to move large quantities without attracting public attention or publicizing their trade on a public order book.

- Execution - OTC allows participants to avoid having to break up their large orders across multiple exchanges, thus avoiding adverse price risk and locking in prices for a certain amount of time.

- Size limits - On exchanges, there are typically limits on order sizes, whereas in OTC, if you're working with a desk that has sizeable inventory and/or an extensive network, there is practically no limit.

Of course, the current structure and immaturity of OTC crypto markets also has drawbacks:

- Liquidity fragmentation - Partially because the industry is still so young, liquidity is fairly scattered which means that it's harder for desks to efficiently source liquidity and, therefore, accommodate larger tickets.

- Operational and settlement risk - In traditional financial markets, platforms like Bloomberg and TradeWeb have become the de-facto OTC messaging and request-for-quote (RFQ) platforms; in crypto participants are literally negotiating deals and sending public addresses to each other on Telegram, Discord, and even LinkedIn (lol), and hoping the counterparty will fulfill their end of the trade.

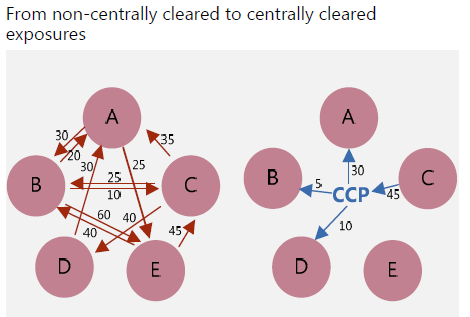

- Counterparty risk - Despite its numerous benefits, bilateral OTC transactions expose participants to greater counterparty risk and operational complexity because of a lack of central clearing counterparty to enforce margin and collateralization requirements, as well as to reduce operational overhead by netting transactions at the end of the trading day.

- Price and rate opacity - Privacy is a double-edged sword which means that price and rate discovery, especially in crypto lending and borrowing markets, is inefficient and opaque.

Looking back, 2020 marked the institutionalization of the crypto space whether we're looking at trading volumes or the Cambrian explosion of infrastructure providers.

Which means that given the fragmented, operationally clunky, and capital inefficient state of OTC crypto trading and lending markets, infrastructure remains one of the key bottlenecks to truly unleashing institutional flows and liquidity into the crypto markets.

How do Lattice and Membrane solve these problems?

Setting aside how the platform might stack up against competitors, and whether it can successfully onboard OTC flows, let's talk about about how the platform is meant to tackle current pain points in OTC crypto markets, as well the interesting second-order implications if it achieves product-market fit.

I should also mention that anything I say in relation to the platform is purely based on the podcast interview and not on having access to privileged information, so we're working at low resolution here.

Having said that, and as mentioned earlier, Lattice and Membrane are a cross-chain digital asset trading, lending, and rate-aggregation platform that lives on top of an algorithmic clearing and settlement engine.

As such, it is aiming to consolidate all the OTC trading and credit flows onto a KYC/AML'd platform.

In doing so, the platform will make sourcing liquidity more efficient by allowing participants to quickly see all anonymous OTC bids and asks in the market, assume most of the technical and operational risks away from market participants (i.e. no more exchanging public keys on Telegram), and reduce counterparty risk by enforcing margining, netting, and trade-failure procedures.

This is where things get interesting.

Netting, at least in traditional markets, is used to reduce operational complexity and gross exposures within the system.

Typically, once positions are netted, the clearinghouse will then send settlement instructions to the counterparties' respective custodians so that the literal asset transfer, be it paper- or book entry-based, can take place.

This process takes time and is the basis for t+2(day) settlement, which is the time it takes for a trade to settle after it has been finalized on an exchange.

In crypto, however, settlement 'takes place' on the blockchain, and so netting OTC transactions before they are submitted to the blockchain has the added benefit of significantly reducing the number of transactions you need to submit - up to 99% - to the blockchain. I don't need to tell you the implications that will have on blockchain congestion and gas fees.

The other major possibility, and this is probably worth its own deep dive, is that aggregating all the borrowing and lending rates from OTC participants would allow for the creation of the first (un)secured inter-dealer interest rate curve for digital assets.

You can almost think of it as the London Inter-Bank Offered Rate (LIBOR) for digital assets, even though LIBOR is technically unsecured lending between a small subset of predefined London banks, and is being phased out of usage.

The implications of this really cannot be overstated but suffice to say that, at least in traditional markets, hundreds of trillions of dollars worth of derivatives and hedging instruments are priced on these types of interest rate curves.

Enabling this type of rate discovery would be a massive unlock for credit intermediation and hedging in institutional crypto markets through derivatives like forwards, futures, and swaps.

What does this have to do with Tokemak?

On the surface, not much.

But this is where we get into speculative territory and should take a step back and look at the broader Tokemak ecosystem, namely Pricers.

If you go to ~3m20s in the podcast, you'll hear Carson talk about some of the roadblocks he encountered when trying to start his own crypto market making fund in late 2018.

Apart from the question of how to custody investor capital, he also encountered the problem of having to pre-fund (in cash and/or crypto) all your positions by funding your account at exchanges in order to execute market making strategies.

(As an aside, one of the good things about exchanges is that they typically offer APIs that you can plug into directly in order to execute automated strategies.)

This is where Tokemak comes in.

Essentially, if you're an OTC desk or market maker on Lattice, you won't need to pre-fund your balance sheet in order to submit prices and execute trades.

All you need to do is to buy TOKE, LD the TOKE in the markets you make, and lock in that liquidity for a week to make markets (and hopefully profit on spread or price drift) on Lattice and Membrane's OTC platforms.

This represents a step-wise shift in capital efficiency and liquidity provision in the institutional market.

Honestly, it's a stroke of genius.

Tokemak is the liquidity utility that will supply liquidity to all crypto markets, retail and institutional.

I could be completely delusional but I think I've glimpsed what's on the other side of the singularity, and WAGMI.

What's next for Lattice?

Back to the facts.

The next big launch over Q4 2021 will be Membrane, with the beta-launch already underway in October and a broader roll-out expected for November and December.

The initial target group will be OTC desks that self-custody and access on-chain strategies themselves.

After that, Membrane will then launch the $BRANE token and introduce the concept of 'trade-mining', where participants can earn pro-rata shares of $BRANE token emissions based on their platform activity, and stake those tokens in order to earn rebates on platform fees.

Finally, at the time the podcast was published, Carson mentioned that he would be releasing some further Medium articles about this project. If you're interested, make sure to follow the releases on Twitter from @arca and @DavidNage.

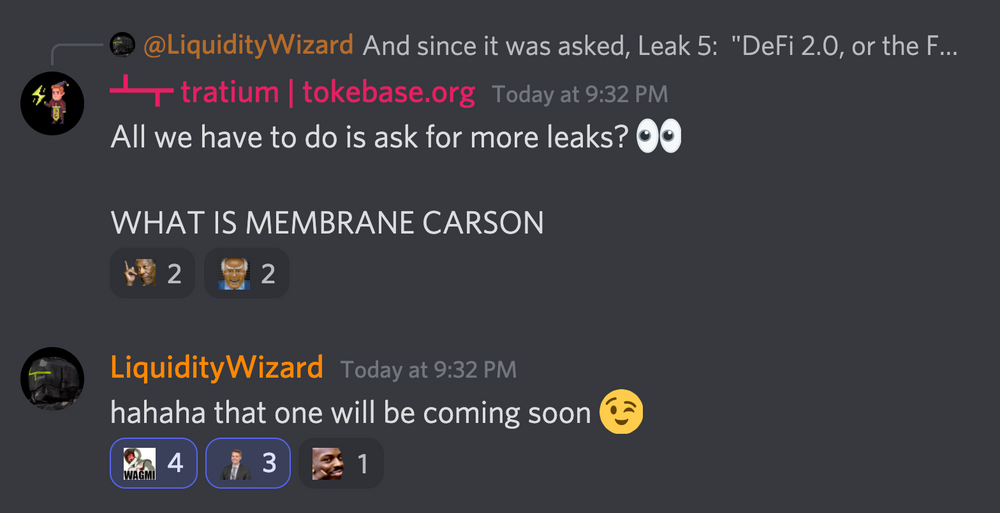

Carson also had this to say on last week's Leaky Sunday:

I think we're just getting an early glimpse of the Tokemak universe and it'll be really interesting to see the synergies between Tokemak and Lattice/Membrane in the near future.

Watch this space.

Tw: @0xParadigm