The team has wrapped up the first "State of the Reactor" community call, and have leaked tons of alpha about new tokenomics that will fast-track Tokemak to the Singularity by further becoming a blackhole for protocol controlled value.

A new Medium article has also been released that outlines many of the concepts discussed during this call.

"Today we're going to start lifting the veil off of a lot of the stuff that we've been heads-down building for a long time now, and we'll continue to be doing so at a pretty rapid clip from here on out." – Liquidity Wizard

Alternatively, the recording is available on SoundCloud.

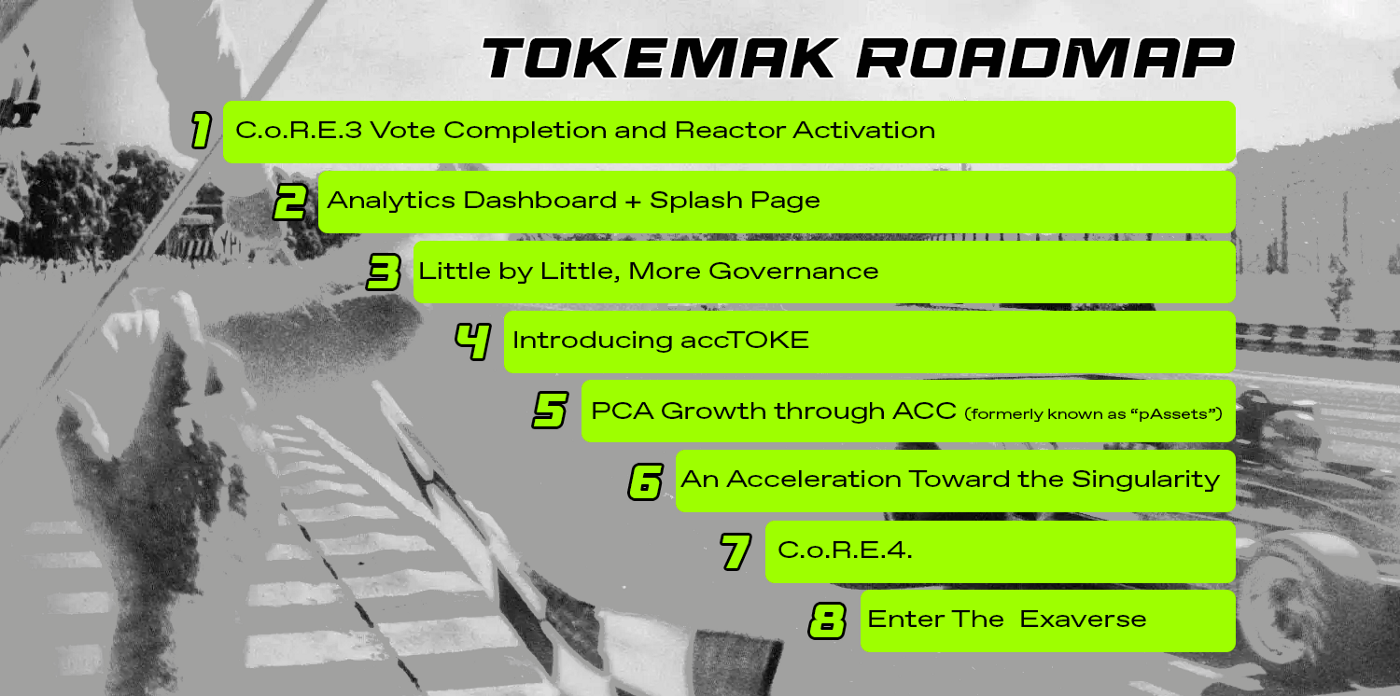

Key Takeaways

- The team plans to host "State of the Reactor" events more regularly in order to answer community questions and give deeper status updates about Tokemak.

- An article detailing the items discussed in this call is in progress, as well as additional articles that dive more deeply into the concepts introduced.

- A new Dune Analytics dashboard will be released imminently.

- A refreshed splash-page for Tokemak.xyz is being developed. It will include a high-level overview of the protocol and key information for educating DAOs on the benefits of Tokemak.

- Despite the fact that the markets are shit, the team ensures the community that they will build through any conditions.

- Huobi will be listing TOKE in the next 36 hours.

- Lots of vote (and likely more bribe) activity is expected in the final days of C.o.R.E.3.

- C.o.R.E.3 momentum will lead quickly to Reactor spin up, and will be followed closely by C.o.R.E.4.

- Reactor spin-up will involve new token mechanics that de-emphasize the DAO to DAO swaps used for previous C.o.R.E. winners.

- The move towards fuller decentralization is in the works, with forum and snapshot voting for "strategic protocol governance" planned.

- A spin on the classic vote-locked tokenomics is coming with "accTOKE".

- Vote-locked TOKE will receive additional benefits based on the duration of lock, including increased governance power and increased yield via a share of protocol revenue.

"If you choose to lock up your TOKE, you will get an increased yield by receiving a portion of the revenue that flows into our protocol.

"That internally is also going to create more demand – more market pressure basically – on TOKE, because that revenue is going to be used to first buy TOKE in order to then distribute TOKE that the protocol acquires on the market out to the locked token holders." – Liquidity Wizard

- accTOKE will be crucial to C.o.R.E.4, where TOKE lockers will receive boosted voting power.

- After C.o.R.E.4, the new governance model will be used to vote for and ignite new Reactors. accTOKE will be a requirement for this, increasing demand for locked TOKE.

- Tokemak is focusing on "Protocol Controlled Value" rather than "Total Value Locked."

- An additional cash-flow token called "ACC" will be launched. This was previously codenamed "pAssets."

- ACC represents revenue that the Tokemak protocol is generating without the underlying TOKE component.

- ACC is minted via the 3rd party assets that are supported in Reactors, and cannot be redeemed for the underlying tokens.

- Assets received when minting ACC are added to the PCV.

"So when you hold [ACC], you get a portion of the revenues that the Tokemak protocol is generating. And those revenues that are distributed are used to market-buy TOKE with whatever the underlying token was that was generated with within our protocol." – Liquidity Wizard

- A portion of protocol revenue will be used to market-buy TOKE via the underlying token that was received and distribute it to accTOKE and ACC holders.

- The "Balancing Act" will begin to factor in the value of assets that flow into the network as well as excess TVL.

"The system will self-optimize for PCV and TVL across all assets as the “balancing equations” expand to encompass ACC as well. Anytime that we have more TVL in a Reactor than can be safely deployed, the rewards will instead move to a bonus for any asset holders who give us PCA in that Cycle. In this way, ACC will have minting bonuses for assets that are preferentially needed by the protocol." – via Medium

- Tokemak aims to become a "Convex for everything." Similar to the way that CVX absorbs CRV, Tokemak plans to accrue value to ACC via PCV growth and revenue generated by every supported Reactor asset.

"Analogous to how Convex has been able to scoop up massive amounts of the CRV token in exchange for cvxCRV...that's sort of conceptually what we're going to be doing. But now we're going to be doing it with every supported asset within Tokemak -- which is going to be expanding dramatically as we open up the ability to vote on new Reactors. So now, all of a sudden, we can bring in any asset, mint, and issue ACC, much like on Convex. CRV comes in in exchange for the minting and issuance of cvxCRV. So if you think about what sort of leverage and network or scale effects that that can unlock, it's quite massive." – Liquidity Wizard

- These new tokenomics will not increase emissions or inflation. The team is on track to continue to make TOKE disinflationary and reduce emissions.

- The ACC minting rate will take into effect the current TVL and value of the received token, so more valuable assets will receive a bigger bonus.

- This mechanic ensures valuable assets are taken in as PCV as the protocol more intelligently emits rewards.

"ACC means accretion, ACC means acceleration, and ACC means accumulation." – Liquidity Wizard

- The Exaverse NFT project will be unique in GameFi. Without revealing too many details, InternetPaul mentions that it will be a playable game that ties back into the Tokeverse.

- Exa will launch with monetizable assets that help grow the community as well as the value of the NFT.

- DeGenesis participants will be able to receive Exa Pilot NFTs.

- end0xiii is an NFT God.

- Tokemak will be further entering the Curve ecosystem with a TOKE/ETH and TOKE/FRAX pool.

- Tokemak will be one of the largest holders of cvxCRV.

- InternetPaul is revolutionizing DeFi-native merchandise with on-chain behavior based unlocks of IRL items.

[00:00:00.550] - end0xiii

All right, we got a nice even 50 people in here. I think that's a good sign. Can kick it off with Liquidity Wizard.

[00:00:12.710] - Carson Cook

Just had to find my mute button again there. Hey, everyone, both on the team and in the community, glad to have everyone here. So this is the first State of the Reactor that we're going to be holding – something we're going to do more frequently along with a number of other things just so that we can have more communication and engagement with the community. I think often on these calls...others on the team will start aggregating...community questions, ideas, etc. in advance of these calls. But for this first one, we really wanted to kick off more with taking you a little bit behind the scenes on a couple of things, including – importantly – the roadmap and a bunch of new features that we will be rolling out shortly. So along those lines, some of the things you're going to hear today will probably be sort of classic "Liquidity Wizard/Carson Chat", where I probably will go off the rails into some pretty deep stuff. So if I lose you, fear not. Later today End is going to be pushing a Medium article that at least touches on each of these topics.

[00:01:17.150] - Carson Cook

And then there's going to be deeper dives on all these things that we'll be doing on other calls as well as dedicated articles. And I think it's worth mentioning that in the current market sentiment, not just internally to Tokemak, but across all crypto and really global macro... I know we're in very uncertain times, and...not a fun market at the moment, but I'll say everyone on the team here, myself included, isn't going anywhere and we'll build through any market...and I could not be more optimistic for the future, regardless of any short term market situations that the space may be in, and any sort of price on things.

So today we're going to start lifting the veil off of a lot of the stuff that we've been heads-down building for a long time now, and we'll continue to be doing so at a pretty rapid clip from here on out. So and everyone on the team, thanks for setting this up. And also I think we'll take feedback from the community as we go in terms of like what you'd like from the State of the Reactor going forward to include.

[00:02:24.170] - Carson Cook

But again, like I was saying: future ones will plan to sort of get pulses sort of from the community and Discord, et cetera, and source some questions. So I think one of the first things I'd like -- actually one of the administrative things. So I think going forward as well...one of the things that maybe doesn't come through super strongly necessarily always in our community or Discord are our rockstar team of developers...who are busy working and often aren't able to be plugged in on the Discord side.

And so I think whether it's the next one or the following one, too -- and I've got a number of our great devs on stage here with me. But I think on one of the next couple we'll try to have one that highlights the dev team behind Tokemak more, where we can go into sort of questions that are maybe a little bit deeper on the technical side, and where you can just get more plugged in with our development team. So, end, any other things at the top of the call here, or should we dig into roadmap?

[00:03:24.770] - end0xiii

No, I was just going to just reiterate that we're going to have an article coming out shortly after this that has some of the high-level highlights, and then probably within a week, I would say...maybe, Carson, we could have kind of like a deeper dive on some of the things that you're going to talk about.

[00:03:43.250] - Carson Cook

Yeah, yeah, exactly. So you're going to hear some new terminology here that soon is going to be sort of embedded into the Tokemak consciousness and community. But don't be concerned or frightened. We're going to make all this stuff a lot more accessible through future discussions and articles.

Okay. So I think given that, let's sort of start...I'm going to kind of go a bit chronologically. And again, I think all of the topics that I hit on right now are going to be things that you're going to be able to see. Each of these things should be at least addressed in the article that End is going to be pushing out later tonight, it sounds like.

So first and foremost, one that might not be addressed in the article within the next 24 hours. I won't say the name because I don't want to remove all... I guess... "surprise." But there's going to be a major sort of top three, top five, exchange that's going to be listing TOKE. So that should be coming here, I think within the next 24 hours, if not 36 hours.

It was already in there? All right. Well, they totally stole my thunder... So it's okay to say the name? It's already out there?

[00:04:57.950] - end0xiii

I got a message from somebody that is not internal that they were aware of it, so I'm assuming that.

[00:05:06.140] - Carson Cook

Okay, cool. Craig, from your perspective? Okay, perfect.

So probably half of you maybe already know this, but we'll be on Huobi within the next 24 hours, I believe, or at least 36 hours...subject to any sort of last minute scheduling things on their end. But that's what they've indicated up to us. So, again, more access points globally for people to access TOKE. So that's great.

Now getting to the actual roadmap stuff here. So we are sitting sort of in the second half of CoRE3, but I'll say we haven't even started the interesting part of CoRE3. Obviously, there's millions of dollars in bribes already being entered or sort of teed-up for entrance when needed. But if this is anything like the CoRE1 and CoRE2, CoRE3 will probably have a crazy amount of activity sort of in the Sunday to Monday timeframes as we go up to... Craig, correct me if I'm wrong, but I believe noon Eastern...? Pacific...? -- conclusion on Monday.

[00:06:07.820] - Craig

Pacific.

[00:06:08.960] - Carson Cook

Pacific. Okay, so noon Pacific Standard time on Monday will be the conclusion, and I anticipate we'll have a lot of activity and probably bribe activity. So for those of you whether you're project-based with your votes or you're economics-based on your votes, make sure you're paying attention to what's happening in Hidden Hand if you're looking on the economic side or you're watching and placing your votes accordingly to the products that you want to see Reactors for.

Following completion of CoRE3, we're going to be using...CoRE3 momentum to go into a bunch of other things here that I'm about to discuss. A bunch of things on the roadmap. Obviously CoRE3 Reactor spin up will be coming next. It's going to look somewhat similar to the past, but with a slightly, I'll call it a "lower requirement" or focus on DAO to DAO token swaps. And the reason actually links into the other things that I'm about to sort of initially unveil on this call shortly involving tokenomics, because we have a better "mousetrap" in order to get the inventory we need. But nonetheless the Reactors will be spinning up. So we'll have the top five projects from CoRE3 which then will get liquidity Reactors and we'll be sort of progressing through turning those on.

[00:07:25.970] - Carson Cook

One of the next things on the agenda here in the coming weeks is going to be evolving our governance. So we sort of started early with operational governance at...very much at the forefront within the Tokemak ecosystem. So liquidity directors being those that route and control liquidity in cyclical time within our protocol, as well as of course the CoRE events telling us...which tokens you would like to see liquidity in going forward.

It's time to now evolve that we're ready to sort of push to the next steps towards sort of full decentralization. So we're going to be establishing forum and snapshot sort of proper, I'll call it "strategic protocol governance" as well. So you can look forward to that with again more opportunities to do more things on the governance side with your TOKE.

And now I'm about to go into the more "exotic" updates, let's call them the next big sort of push...and all this is actually focused on the evolved tokenomics which we have been long planning. We always knew that the early stage was going to be a stepping stone to sort of this next stage of phase, and central to this are two...new concepts.

[00:08:50.510] - Carson Cook

So the first thing that we intend to launch or that currently on a roadmap we think comes first is going to be something we're calling accTOKE. So lowercase "acc"-"TOKE."

This is effectively a vote locking mechanism. So think "vl" a-la vlCVX -- a vote locking mechanism that we are going to open for TOKE, where now users and protocols are able to lock up their TOKE for longer periods of time in order to get a number of benefits including juiced governance. So a few of these things...anyone on the team is welcome to chime in with additional ones that I might miss here. But a few of them that we will be unveiling is...effectively the concept of shared increased yield via a share or a portion of protocol revenue.

So I think on our last weekly snapshot even with...the current depressed markets where anything we're yielding is of course a lower dollar value, I think we brought in around $750,000 USDC worth of tokens. And with this new accTOKE possibility, if you choose to lock up your TOKE, you will get an increased yield by receiving a portion of the revenue that flows into our protocol.

[00:10:20.310] - Carson Cook

That internally is also going to create more demand, more market pressure basically on TOKE because that revenue is going to be used to first buy TOKE in order to then distribute TOKE that the protocol acquires on the market out to the locked token holders -- these accTOKE holders. Several other things here and again I'm just going to skim the surface on all this stuff.

accTOKE is planned to have increased liquidity control, so those that hold this locked form of TOKE will get stronger control over liquidity direction. This of course can be very important for different token projects, different stablecoin providers, exchanges, large holders, and people sort of entrenched in the ecosystem that want and care about a lot of control of liquidity within the ecosystem to direct it wherever they need. So they will likely sort of lock up tokens in this accTOKE model.

Other couple of things include boosted voting power. So for CoRE4, which we are planning to do unlike CoRE1, CoRE2, where we wanted to make sure one that we got the actual liquidity deployments going and sort of were on the backend building a ton of stuff...and our devs have been very busy on the backend doing a lot of things that, again, on one of the future calls I want to detail all the things they've been working on.

[00:11:48.750] - Carson Cook

We wanted to make sure that here we have CoRE3 and we use the momentum more rapidly to get to CoRE4. CoRE4 we plan to launch shortly after we unleash this locking mechanism, so that accTOKE holders are able to get sort of more voting power in CoRE4 which again will drive more demand to lock TOKE into this model.

Let's see the last one that I at least cover here -- and there's a few other things -- the last one I'll cover for now is additional governance in general. So there's a number of new governance features that accTOKE will unlock. One of them is that post-CoRE, we are planning to move to a model where anyone can sort of propose a new Reactor, a new liquidity Reactor for a project, and subject to sufficient TOKE votes, or in this case accTOKE votes, they will then be able to ignite that Reactor. So accTOKE will actually be a requirement in order to vote on approval of new Reactors once we can go through the line of CoRE events, which...we're planning to do CoRE3 and CoRE4 at this time before we move to this more evolved model.

[00:13:02.910] - Carson Cook

So I'm throwing a lot at you, but that's I think what's probably worth covering for now on the accTOKE side. And by the way, the name of that will probably become sooner shortly. So as mentioned, after accTOKE launches, we'll be doing CoRE4 with the opportunity for the community and protocols to get boosted vote power in CoRE4 using accTOKE.

If you were a little bit lost on the last one, you might get a little more lost here. But again, if you're not, there's going to be the article tonight and deep dive articles on this.

So the next thing is we are really focused on growing the PCV, the protocol controlled value within Tokemak, so much so that we have a number of metrics that we're going to be rolling out and focused on...that are very much focused on...the next I would call "evolution of metrics" that are fundamentals that people should care about within DeFi. So rather than being focused on TVL, which the space at the moment is hyper focused on total value locked – which, if you think about it, is basically how much debt financing a protocol can bring in – we instead want to be focused on PCV.

[00:14:20.920] - Carson Cook

So protocol controlled value is really the portfolio of PCA or protocol controlled assets, which just means it has both the number of PCV, how much is it worth, plus the actual portfolio makeup or diversification therein. The mechanism by which we will dramatically increase PCV is through the launch of a new token that is effectively...I'll call it a "cash flow" token.

This token, by the way, is not to in any way compete with TOKE. It doesn't drive any of the demand away from that. In fact, much to the opposite: it drives massive value back to TOKE, and you're going to see this soon. But ACC effectively is a way where anyone can give us any supported asset on Tokemak at any point in time. It goes directly into our PCV, so we have no tAsset liability like we do with liquidity providers and TVL, and instead we mint. So there's no...max supply to this. As we bring in effectively, we'll call it "revenue" in quotes – as people hand us SNX or ALCX or FRAX or FEI – we mint ACC and hand them back this token.

So what exactly is ACC and why do people want it?

[00:15:38.360] - Carson Cook

So ACC is effectively a token that is the cash flow component of what I was saying -- the vote locked TOKE or accTOKE -- gives you without the underlying sort of TOKE mapping.

So when you hold this token, you get a portion of the revenues that the Tokemak protocol is generating. And those revenues that are distributed are used to market-buy TOKE with whatever the underlying token was that was generated with within our protocol.

And again, for those of you that might not be paying attention to the side right now, we're generating – this is kind of ballpark, and of course the market is correcting lately so this can vary quite a bit – but let's call it $4-6 million in revenue per month right now at the protocol level.

So this asset, the mechanism people can get this is...at any point in time all of our balancing equations that right now, balance liquidity providers with liquidity directors...are about to get an additional dimension that balances not only the TVL provided by liquidity providers with the TOKE votes for the liquidity directors, but also inflows of assets via people that are willing to hand Tokemak additional PCV in exchange for this ACC token.

[00:17:06.260] - Carson Cook

And I want to explain why the ACC here. People will be interested in doing this because there will be a secondary market for it. So while we won't ever redeem it back for their original tokens, we will be using our governance power elsewhere. A number of you probably know what I mean by that – in order to stand up a secondary market for this.

So if you think about it, for any of you that are deep on the Curve and Convex ecosystem, this is somewhat analogous. Albeit with some difference...but somewhat analogous to how Convex has been able to scoop up massive amounts of the CRV token in exchange for cvxCRV. That's sort of conceptually what we're going to be doing. But now we're going to be doing it with every supported asset within Tokemak – which is going to be expanding dramatically as we open up the ability to vote on new Reactors.

So now, all of a sudden, we can bring in any asset, mint, and issue ACC, much like on Convex. CRV comes in in exchange for the minting and issuance of cvxCRV. So if you think about what sort of leverage and network or scale effects that that can unlock, it's quite massive.

[00:18:18.410] - Carson Cook

If you think about how that happens. And we're going to get similar sort of leverage effects running on the back end, too deep for this call, but on the back end, I'll sort of...[...] what Convex has done. So I think...let me just see if there's anything. Let me pause for a second to see if anyone in my team, especially on the ACC one, has anything to say on that that I missed at a high level prior to me sort of going through the Singularity and why it's called ACC.

[00:18:49.140] - SHARP

And I would just like to emphasize that besides the revenue share, which obviously is crucial for the vote lock version of TOKE, it's interesting to think about the bribing market that will arise with a new governance power that is associated with this. So these driving markets are something that is not present on this CoRE event. But going forward, it's going to be a dynamic that I'm really looking forward to playing out.

[00:19:17.300] - Carson Cook

Yes, completely.

[00:19:22.650] - 70k3m3ch

I just want to add just a quick note. I just was looking at some of the chats. There were some questions as to just go into more detail. So I just wanted to add, of course, more detail to this. Like how the logic there's a logic behind, for example, the ACC tokens...like which ones the system deems currently of higher value. These kind of things. I don't think we're going to go into this now because otherwise everyone's going to get turbo confused. We're definitely going to cover these then in this more detailed article that we're working on with end, and then we hope to get it out the door next week.

[00:20:10.570] - SHARP

I guess that we can provide the quick TLDR, which is that we can model the demand through bonus within this new token. So obviously, depending on the utility that the new token that we are observing to the PCV brings to the system, we will price it differently.

[00:20:29.410] - Carson Cook

Yes, exactly right. And I was actually going to just layer on a couple of things, one of which kind of hits on that.

So first is: a beautiful part about this is that this whole sort of new mousetrap – and it's a lot bigger than just a mouse trap – can be done without really increasing emissions or inflation. So we're all focused on actually disinflating things, reducing emissions...but doing that in a way where we need TVL, they're still an attractive APR on the system, but doing it in a sustainable way.

And to what was just...mentioned, the way the equations work is they reassign bonuses. So if we have too much TVL, then can be safely deployed in one Reactor, we actually take the amount that can't be deployed and the rewards associated with it for that cycle. Reallocate those as sort of a minting bonus to those that come in hand us that asset, say ABC, but to our PCV or PCA and instead mint and receive ACC, they will get basically that bonus. So it's actually a reassignment and a much more clever and intelligent use of rewards and emissions for exactly what the protocol needs and the net result of sort of all of this.

And again, I'm sure everyone...like half the people on the call are completely confused, probably, right now...and half of them are half confused. But again, we're going to be going through a lot more detail...but I want to at least introduce these things. So apologies...these are probably a little overwhelming initially, but the goal of this is it's a shift in mindset to...it still exactly remains with what we've always been planning, which is: Tokemak is a liquidity machine.

It basically provides the liquidity bandwidth of web3. But it's a little bit of an inversion of the way that probably people have been thinking about this when they first think of, oh, people put in TVL and we deploy that. Now it becomes a game of massively expanding the PCV...and we're going to be introducing, eventually, metrics that will be eventually become very important in all of DeFi. So for example, the PCV to TVL ratio – it now becomes "how do you grow that"? And then: "how do you effectively deploy the PCV as liquidity bandwidth, with as much TVL as we can safely and effectively deploy across DeFi?"

[00:22:51.040] - Carson Cook

So it just becomes a slight sort of difference in how we think about this. And again, PCV...if you take nothing away from this, just know that PCV is good because the protocol owns it outright, unlike TVL which we have to give back to depositors. And more PCV means there's more backing every TOKE, and therefore a bigger balance sheet for TOKE holders, which can generate more revenue and profits, again...indirectly maybe at first, but for TOKE holders.

Okay, so I want to move on just because in four minutes I will have to jump onto another call and I want to get a couple more things. Next is...all of this is going towards is...an acceleration – the concept that we talked about very early on about Tokemak becoming a self-sustaining liquidity machine that powers DeFi and web3.

So the question is "why did we call it ACC," right? We have this new ACC token that people get when they provide PCV into protocol controlled assets into Tokemak. And then we have accTOKE when you lock your TOKE up. And the reason is that all of this is basically to accelerate us towards the singularity or an acceleration.

[00:24:08.800] - Carson Cook

But it goes further than that. There's actually sort of a trio of words...for why we really liked ACC as we use this as the mechanism to get towards the singularity.

So for any of you physics nerds in the crowd: accretion is basically the process of growth or increased accumulation of additional layers of matter. And there's the concept with stellar objects – and in particular here black holes – called an accretion disk...which is basically a structure of materials that's orbiting around a black hole – kind of forever approaching the singularity. In some cases not forever, but approaching the singularity.

And so ACC means accretion, ACC means acceleration, and ACC means accumulation.

And we want...action words to describe it because all of this will support and reinforce Tokemak and the TOKE token...all that's going to be incredibly powerful. So I think with that, that's sort of it on what I'll call the tokeconomics side of things.

There is one more thing I want to briefly hit on. It looks like we do have Paul on -- Paul, do you want to get...I'll actually just do a quick note, but InternetPaul and number people on the team have been hard on work on the project, code named Exaverse with the Pilots. And I would say...I'll hand it over to him for a minute here, but they're doing some really innovative things, making sure that this isn't just sort of a copy paste project...that it's really innovative, and that it also supports the core mission of Tokemak and liquidity bandwidth as well in a unique way. So, Paul, anything you want to say on that?

[00:25:48.010] - Internet Paul

Yeah, we had a lot of requests to do NFTs, and I think part of our company culture is when we do something, we don't want to just do the status quo. So we've been trying to figure out – and have succeeded in figuring out – how to make an entrance into this market in a meaningful way that actually maps back to Tokemak.

So there are two things to know about the projects that are the most important, one of which is that the tokenomics are going to be tied to Tokemak in a way that is directly beneficial and sort of building towards that singularity event. And so we really don't want to say too much until we get to a point where we're comfortable sort of quickly launching after revealing what we've been doing. But suffice to say that it is different than any other sort of GameFi or NFT related project that you might see.

It is a game, it will be playable, and there's sort of a more traditional game, something you might associate with GameFi now. And there's a...fully unique element that we uncovered in our process of trying to figure out what to do that I think is really interesting...and we are not aware of anyone else who is currently doing it. So I can't wait to reveal it, but I've been trying my best not to say too much so that we can be first to market with this idea.

[00:27:26.510] - Carson Cook

Yeah. And I'll just reiterate: Paul and team have some really innovative things happening there. So a lot to be excited about. But I would agree with Paul. We want to unveil at the right moment. So it's definitely not a copy paste project in any way. And again, it's going to support the core Tokemak mission and others as well.

[00:27:46.050] - Internet Paul

But maybe one more thing that we can say is: part of the reason that we were able to land where we landed is that we've watched as other successful NFTs that sort of have, from left field, had a lot of success. They're now backing into monetization models from already having a community and being well known.

They're trying to figure out how to go back and give the thing a soul, whereas we are going to be growing both the community, the value of the NFT, as well as what I would call a basis of monetizable... I guess we'll just say "assets"... all at the same time from the bottom up.

[00:28:26.870] - Carson Cook

Yes, well said. And I hate to do it, but I will have to jump here because I'm late to another call. I think some of the other people on the team may be able to stay another minute or two. But just to wrap up on my side before I jump, you're going to be hearing a lot more from me and the team going forward. We have a ton of stuff that we're building.

Bear markets are great for builders, and this team is completely full of builders. So rest assured, we're doing a ton of stuff. And you're going to be hearing a lot from us on that side. And going forward, too, I want to be able to be plugged in on questions, too.

So on the next one, we'll make sure that I don't have an immediate call after, where we can do some questions, and where I spend the whole time talking as opposed to taking questions and listening. So thank you all for jumping in on a week when the markets are rough and everything. Hang in there...a lot more to come. And again, I think the team can stay for a minute if there were any questions that end is trying to field.

[00:29:22.210] - Carson Cook

Thanks, everyone. Yes.

[00:29:24.320] - end0xiii

And I just want to reiterate what Carson just said, which is that as I said yesterday in the captain announcement: we're going to try to do this once a month in kind of a structured way, where we gather some questions from the Captains and we can have...a more focused conversation about the significant topics that people want answers to and also include more people...as like Carson said in the beginning of the call, like the devs...and continue to familiarize yourselves with the team, because they're an incredible dev team. And I know they're not like on Crypto Twitter in kind of a big name, but they're an incredible team, and I think they deserve more spotlight.

And then the last thing I'll say about the exhibit thing is...there are two things. I don't want people to think that we're just trying to jump into this NFT world just because NFTs have blown up. I think everybody probably kind of knows I'm like a pretty big NFT degen guy. But if you recall from the inception of...creating our sort of mascot of Tokemak, which is the Tokemechs...we started working with crypto-native artists right away, and we think it's an incredibly important part of the community and want to try to strengthen that community identity.

[00:30:49.990] - end0xiii

So that's kind of part of the incentive to breathe life into the Leaky Reactor and dive deeper into this world. So there's that.

And then also we should also reiterate, or at least communicate, that the Exaverse project is like a side project. It's not taking away any of the core devs on Tokemak time. We have two other separate devs that are better helping us with this thing, and we will surely reveal more when we're able to. But this is the project where DeGenesis participants will be able to get their pilot NFTs that we've been talking about for so long.

So we don't have an exact timeline on the launch, but we're getting closer and closer, and we have some really cool ideas, so we're excited to share that with everybody.

[00:31:42.770] - Internet Paul

Yeah, maybe. It's just good to note that there is like a more formally written out piece of the Medium article that you're putting out, that is specifically focused on Exaverse. It does have more information. I was just having a bit of a hard time speaking to it without sort of revealing what we're hoping to keep under wraps for just a few more weeks before we try to unveil it. But there's more information than I was able to get out on the call that will be in that article that...if you're interested, you can review.

[00:32:17.830] - end0xiii

Okay, cool. All right. Anybody else before we wrap this up? I know we went over a little bit, but we're excited to have these more often, and we love all of you. Thanks for sticking with us. So anybody else want to say hi or bye bye?

[00:32:36.610] - SHARP

Yeah, I have just a quick update for next week...I think that it's safe to say that we are going to enter the Curve economy. So we are going to submit for governance discussion a proposal for TOKE/ETH pool, and hopefully we will submit shortly after the on-chain vote. And we have already enough CVX to properly incentivize liquidity within Curve v2. And this is a step forward to also make Tokemak's liquidity more sustainable. And eventually we will also add the TOKE/FRAX pool.

[00:33:25.150] - SHARP

You mentioned that this is also part of the reasoning between behind the unwinding of the Uniswap pool...and part of the Convex and Curve strategy all converges to this...and Tokemak will also be one of the largest holders of cvxCRV. This is going to prove to be very important for the future sustainability of the protocol.

[00:33:51.910] - Internet Paul

Okay. Final thought is that I have been working very hard on what, again...I think it's an innovative approach to this time. Pretty superfluous, but: merchandise. We built an achievement site that will allow for you to unlock patches that go on the sweatshirts. So each sweatshirt has a patch receiver like a Velcro pad, which is sort of like the military, which you'll be able to -- via your on-chain behavior -- unlock achievement patches in order to customize your hoodie. So keep a lookout for that. Again, I think it's a first. I'm not aware of anyone else doing sort of IRL unlockable things based on on-chain behavior.

[00:34:37.870] - end0xiii

All right.

[00:34:38.620] - SHARP

Sweet.

[00:34:39.250] - end0xiii

Thanks, everybody, for joining us. Thank you to the team for getting up here, and we're looking forward to doing this more often. So thanks everyone. We will talk to you soon.

[00:34:53.170] - SHARP

Yeah. Thank you, guys. Thanks guys.