One random Wednesday I shuffled my tired body inside The Leaky and on to the bar. I stood there waiting for a drink.

🥃

I could feel the exhaustion of an already long week, which was far from finished, settle on my shoulders like a heavy coat. As I sat there letting the alcohol and exhaustion mix in my blood, I became aware of a grizzled stranger peering at me from across the bar.

“Heh. Another shot-out Degen.”

He grumbled to himself. He shifted out of his seat, his gaze now set in the distance, and boomed in a heavy voice:

“The farms, the wars, the bribes, all of it… It’s all about liquidity. Always has been.”

He turned his penetrating gaze back to me, paused, set a heavy glass on the bar, and walked out.

Whether you care for fantastical illustrations of web3 life or not, the point is this:

DeFi and web3 have been wrestling with liquidity since the beginning.

Degens, anons, tourists, and everyone else in this space endures roller coaster markets, a constant firehose of information, and endless sifting for useful insight. It’s both exciting and tiresome. One common issue throughout all this, though, has been deep, sustainable liquidity.

The thirst for sustainable liquidity across web3 eventually developed into the DeFi 2.0 movement and the CRV Wars.

A few months ago, I wrote this article’s predecessor, “The Liquidity Wars: Arrival of the Tokemechs” covering these events and the next catalyst: Tokemak.

Now it’s Time to Brace for Impact.

Over the past month Tokemak has begun the long-awaited deployment of liquidity. It begins with deployment on Curve Finance and a series of announcements from Liquidity Wizard himself revealing the deep connections between Curve and Tokemak.

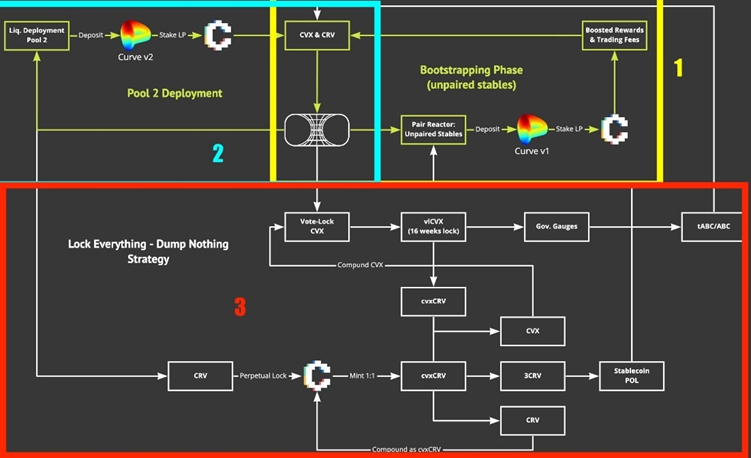

This image caught a lot of flack on CT for its complexity, but thanks to one of the helpful Tokemak Commanders, 70k3m3ch, we can break it down as follows:

1. Square 1 (yellow) - Tokemak LPs stables into Curve and then uses the gained $CRV for locks in Convex

a. If you have used Curve and Convex, then you likely understand this interaction quite well

b. This part leverages any unpaired assets amongst the Pair Reactors in Tokemak

2. Square 2 (blue) - references engagement in Curve v2 to gain additional $CRV/$CVX rewards

3. Square 3 (red) - This bottom section is where partnership and the pursuit of stability shine. Tokemak will lock all $CRV & $CVX, enabling the protocol to:

a. Earn bribes through Votium in the absence of desired gauges

b. If gauges are available, Tokemak would be able to yield more $CRV, $CVX, and stable assets. The additional $CRV and $CVX would be locked again, and any earned stables would be placed in Tokemak’s PCV.

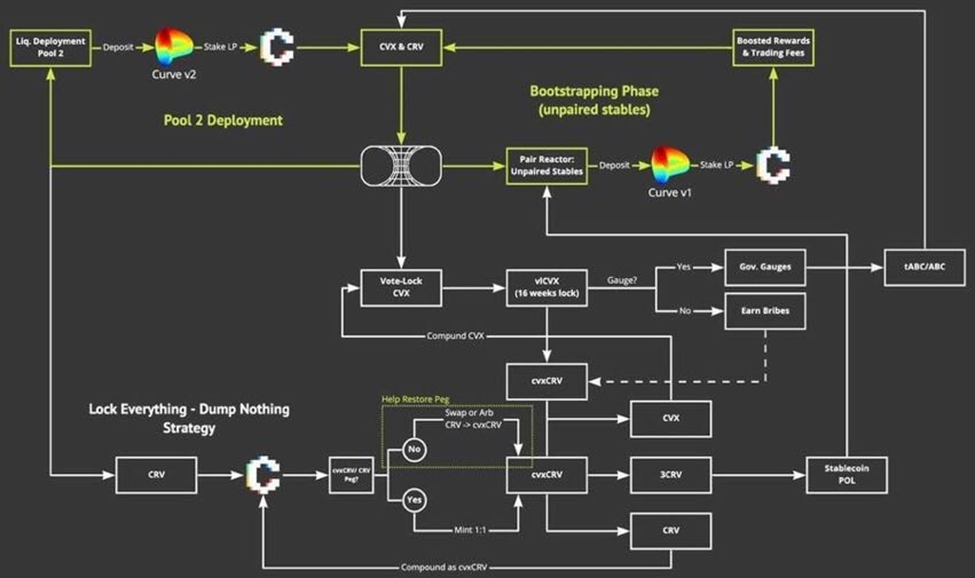

Giga-brain S. Archer wrote a great thread on this “lock everything, dump nothing” strategy and dropped a similar diagram with a few additional highlights.

The illustration above is another element to Tokemak showing its continued development toward its main objective, which is to be a source of sustainable liquidity across web3. The strategy above creates a symbiotic relationship between the stableswap protocol Curve and the liquidity black hole Tokemak. Tokemak gets a boost in its liquidity providing/directing, and Curve gains some of the liquidity benefits from Tokemak as well as a partner that will utilize its token without creating sell pressure.

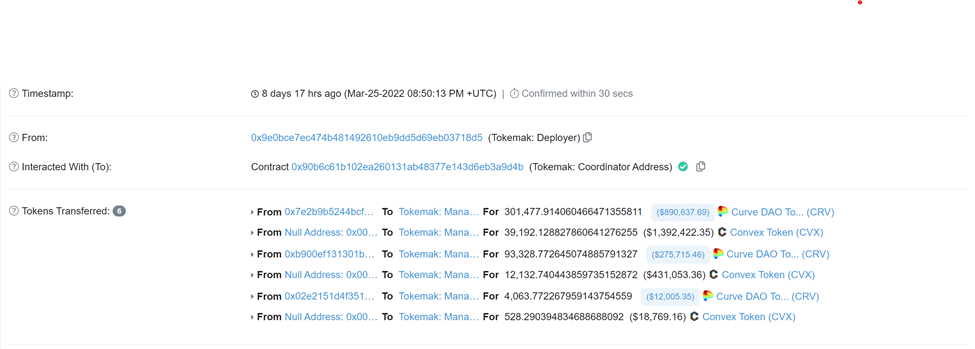

Liquidity Deployment began a staged rollout in about late February, and in a month’s time Tokemak would capture ~398,870.45 $CRV and ~51,853.16 $CVX. At the time of that transaction, the total value of claimed tokens was $3,020,603.37!

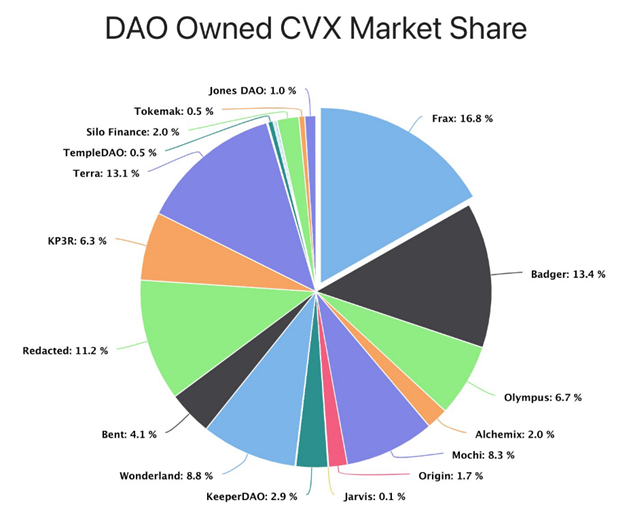

In just this short period of activity between $CRV and $CVX, Tokemak has already secured 0.5% of the $CVX market share.

It’s important to note that this sudden presence in the CRV wars is only after one month’s scaled deployment. As the effect of the liquidity black hole accelerates, we will see the impact not only on Curve and Convex, but across the rest of the Tokemak partners…which, by the way, you may notice are some of the largest $CVX holders in the chart above…which is the perfect transition to my next section.

“The Curve Wars are Over”

In a recent post, Do Kwon made a bold statement on the state of the Curve Wars. His statement that the “Curve Wars are over”, came from the recent announcement from Terra regarding 4 pool. Essentially, many of the DeFi 2.0 players have banded together to leverage their combined $CVX influence to implement a new stable pool on Curve that will displace the current leader, 3pool. This quote from the announcement captures the thought behind 4pool:

Introducing the 4pool, the new gold standard for stablecoin liquidity, bridging the gap between decentralized and centralized stables. The 4pool is a new curve pool composed of UST, FRAX, USDC, and USDT. Together Terra and Frax will concentrate stablecoin liquidity across 4pools on every major chain via Curve. Initially, 4pool will be tested on Fantom 66, Arbitrum 35, and mainnet Ethereum (once a Curve fix is deployed to allow this pool to be made on Eth).

Currently, UST and FRAX directly compete against each other for CVX/CRV emissions through votium incentives and vlCVX votes while each of us subsidizes 3CRV, this war is unlikely to end given both of us have enough firepower. Instead, together, we can focus on growing the entire decentralized stablecoin pie and help create sufficient liquidity to allow the entire DeFi industry to transition to greater usage of decentralized stablecoins. Ultimately, DeFi cannot follow through with its cardinal rule of decentralization while using stablecoins that can be censored by any one entity.

Frax and Terra are the two largest protocol holders of CVX (over 3.65m CVX cumulatively) and the two largest votium incentivisoooors (7m in FXS and 4m in UST) thus together they can direct vlCVX power and votium incentives to make 4pool the most liquid and utilized stablepool across chains. Together they effectively get more liquidity per dollar spent.

The 4pool ethos is the realization that “stablecoin pegs are stronger together than competing against each other.” That’s why Terra and Frax have decided to support this new DeFi primitive on all chains through Curve Finance’s deep stableswap technology. Additionally, given the depth of resources both projects will pour into making 4pool successful, we expect 4pool staking to be a new gold standard of stablecoin yield in all chains that 4pool is found - aside from Anchor of course ;).

Additionally, given how the FRAX AMO 40 structure works, the 4pool enables UST to become a collateral asset for FRAX, further aligning interests between the projects since as FRAX grows UST grows too and vice versa.”

This statement outlines many other important notes, but I want to focus on the alliance forming around 4pool. As you will notice, many (if not all) have strong Tokemak ties.

The announcement of 4pool and statements like Do Kwon’s led to a flurry of exchanges on CT. Many challenged the ability of the 4pool alliance to truly dethrone 3pool, some decried a DeFi doomsday where DAI loses its peg, and others simply went back to old narratives of dismissal for DeFi 2.0 protocols.

For the sake of time, I won’t cover all of this here, but I will place links below to some useful threads on this developing situation.

- Do Kwon 4pool announcement: “CRV wars over”

- GMI announcement

- OlympusDAO and Zeus joining

- Official Terra 4pool announcement

- Crypto FI’s thread on Curve wars and the belligerents

- CryptoCondom 50% counter-argument

The current 4pool alliance, subject to change as this is still developing, is as follows:

- Terra

- Frax

- Redacted

- OlympusDAO (proposed)

These protocols have strong ties across the following:

- Pickle Finance (through Frax)

- Stargate Finance

- Alchemix (strong ties with Olympus and Redacted)

- Tracer

- Dopex

- JonesDAO

Of course, it may just be easier to look at infamous crypto whale Tetranode’s profile pic to get an idea of how far these relationships extend.

Tetranode has been a long participant in CRV wars, and has led and rallied many initiatives across these protocols to increase their $CRV and $CVX holdings. His power and determination in establishing this dominance was demonstrated when Mochi Finance attempted to front-run one of these initiatives. That move ultimately ended in Tetranode nuking Mochi’s pool to zero.

From a Tokemak standpoint, Tetranode has loomed in the distance – but considering his ties to many of Tokemak’s partners, it would be safe to assume he is well aware of the liquidity black hole. I’ve stressed this before, but it bears repeating: follow this warrior whale and be aware of his activity. His power and influence runs deep throughout DeFi.

Now I have spent a lot of time sharing background on the CRV wars and the recent 4pool development, but I promise it plays a huge role. With the battle lines now seemingly drawn on 4pool, and in a more abstract manner between DeFi 1.0 & 2.0, we see the $CRV/$CVX accumulation and access to that liquidity becoming highly contested. It will be natural for former, current, and future contestants to look for more liquidity options elsewhere. Not to mention that this contest for liquidity continues to pull resources that were formerly used to attract farmers, and are now likely used for gauge bribes.

DeFi 2.0 protocols at this time seem to have quite an edge, as it has been a major focus of their movement and created some very strong bonds. Defi 2.0 has a strong presence in $CVX and, as you will see further down, early moves into $TOKE.

As the contest for $CRV – and, ultimately, sustainable liquidity – escalates further and further, you can almost hear the Tokemechs rumbling in the distance…

Tapping the Liquidity Black Hole

While stables and the Curve gauges currently serve as a strong source of liquidity for DeFi, Tokemak is opening the doors to a liquidity hub capable of greater reach and depth.

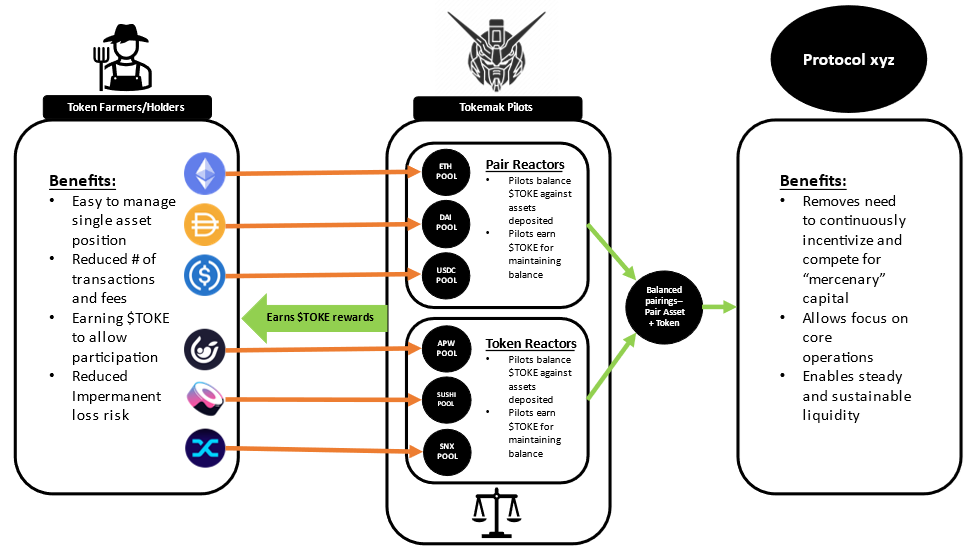

I put together a simple diagram for one of my earlier Tokemak articles, and I think it is helpful to point out just how simple and powerful Tokemak can be.

Above you will notice that anyone can enter a single staked position on Tokemak to earn yield. For each token-specific Reactor (pool) available, users are able to single stake their assets, thereby avoiding impermanent loss. After C.o.R.E. 3, the Tokemak team plans to implement the capability for permissionless reactors. This means that a reactor can be enabled for any asset, provided there are enough votes from $TOKE holders (Pilots). As assets are staked, the $TOKE holders – or Pilots as they are referred to inside Tokemak – are incentivized to vote their $TOKE to Reactors in need of balancing, aka higher APR. Tokemak is essentially creating the balanced pairings needed for LP in one place, as opposed to the current fractured placement across web3. It pairs, packages, and manages the deployment of this liquidity to protocols. This benefits the farmers, Pilots, and protocols, as it ends the current game of musical chairs where protocols pursue the ever-fleeting mercenary capital.

Additionally, this allows web3 to source liquidity from beyond the usual suspects: stables. That is why Tokemak calls itself a blackhole for liquidity. There is no limit to the depth this liquidity can go. That depth will be very important, and will likely increase significantly once Tokemak’s sibling project Membrane goes live. There is not enough space in this article to explore Membrane, but Membrane opens the floodgates to OTC trading and aims to be a unified credit layer. In short: deeper liquidity, bigger transactions, and bigger fish.

Membrane articles:

Now, with the immense power that Tokemak holds, let’s look at the current state of DAO holdings in the TOKE Wars…

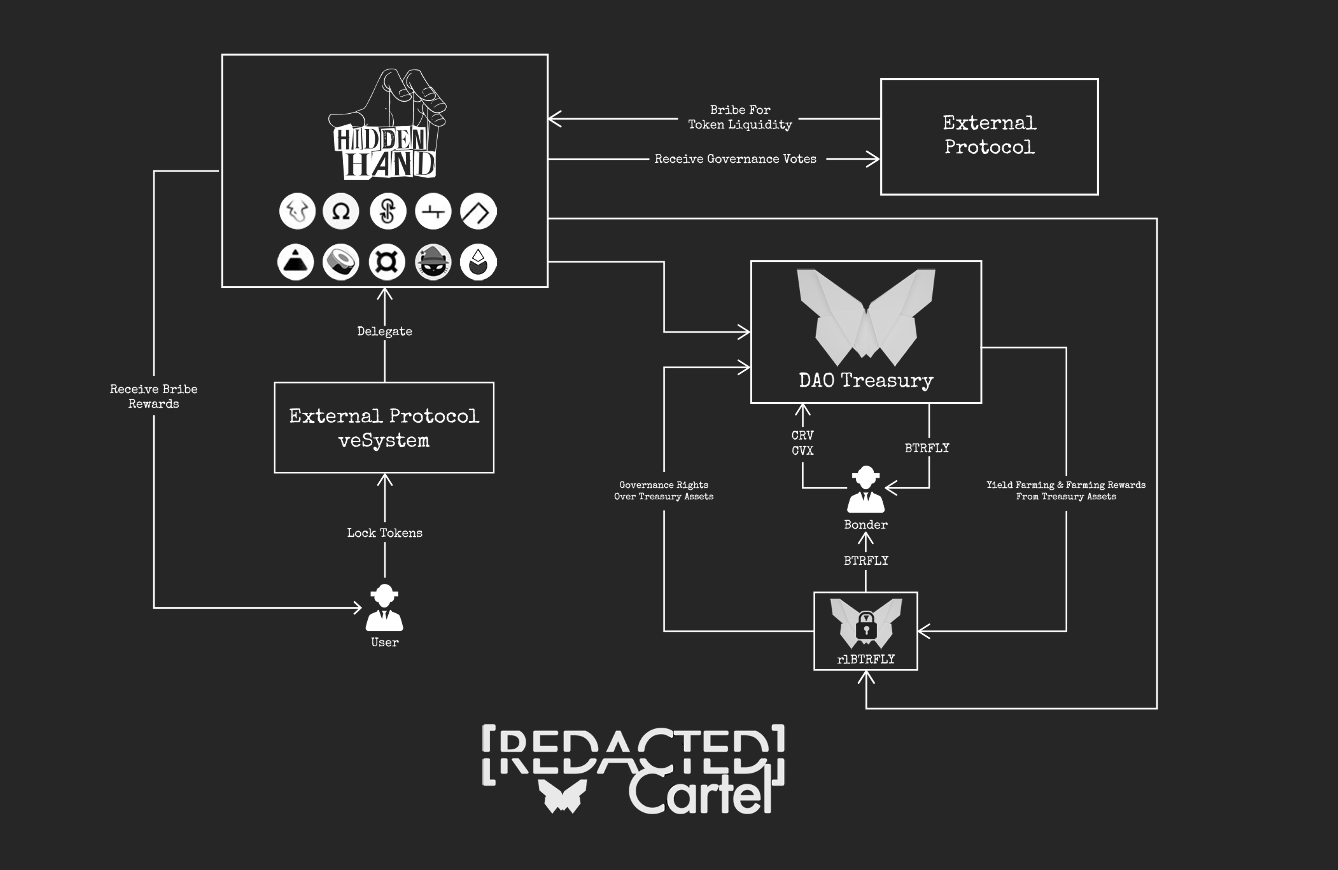

You will notice a strong presence of DeFi 2.0 players, and of course that the 4pool alliance (Olympus, Frax, and Terra) hold a majority. I will also add here that REDACTED’s Hidden Hand market for bribes will be used for bribing $TOKE holders' votes in C.o.R.E. 3 and future events. The Hidden Hand market will encompass more than just Tokemak and Redacted… - *cough* FRAX *cough*

That is another breadcrumb I will leave for you to investigate…

REDACTED also recently stated that Terra will be using the Hidden Hand market to secure its own reactor within Tokemak.

If you thought DeFi 2.0 was dead, you better dust off those old Twitter threads. When the sensationalism and pumpers left, the builders doubled down, and it is showing.

Here is a quick grouping of protocols involved in 4pool, Tokemak, or with strong ties to those groups:

- OlympusDAO

- Terra

- REDACTED

- Tokemak

- Alchemix

- TracerDAO

- JonesDAO

- Dopex

- Frax

- Vesta

- Fei/Tribe

- Rari

If you explore this list, you will see it runs the gamut of DeFi activity, with a wide breadth of options to entice web3 users. You have lending, options, perpetuals, stables, reserves, bonds, and more. Add to that Tokemak’s planned $EXA, NFT/Exaverse, alongside Membrane and you have a very large ecosystem early in the making.

What It Is and What It Isn’t

The point of this article is not to claim an end to the CRV Wars, pronounce one protocol's or individual’s superiority over another, or stoke the fires of the DeFi 1.0 vs. 2.0 arguments.

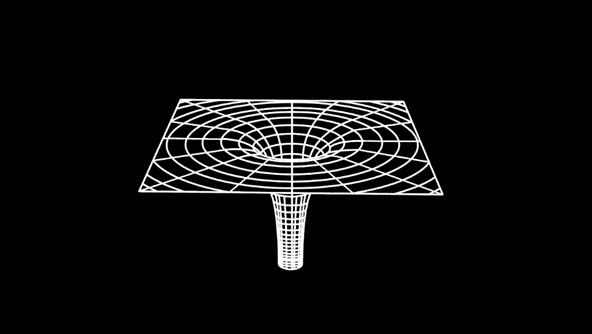

The aim is to draw awareness to the catalyst that is Tokemak. It's a blackhole of liquidity aiming to branch out across web3. The CRV Wars, 4pool, C.o.R.E.3, Membrane, REDACTED’s Hidden Hand market, and all the other exciting developments surrounding Tokemak partners are dancing along the edge of the growing liquidity black hole.

A shift is looming. The $TOKE wars are already underway and will begin to unfold at an exponential rate.

Some of you will see this…

But the Pilots will see this…

☢️❄️ Stay Frosty ❄️☢️